How to do Futures Trading on CoinW

In this comprehensive guide, we will walk you through the fundamentals of futures trading on CoinW, covering key concepts, essential terminology, and step-by-step instructions to help both beginners and experienced traders navigate this exciting market.

What are Futures Contracts Trading?

Futures Trading: In the Futures market, a position opened is a Futures contract representing the value of a specific cryptocurrency. When it is opened, you do not own the underlying cryptocurrency, but a contract that you agree to buy or sell a specific cryptocurrency at some point in the future.For example: If you buy BTC with USDT in the spot market, the BTC you buy will be displayed in the asset list in your account, which means that you already own and hold the BTC;

In the contract market, if you open a long BTC position with USDT, the BTC you buy will not be displayed in your Futures account, it only displays the position which means you have the right to sell the BTC in the future to get profit or loss.

Overall, perpetual futures contracts can be a useful tool for traders looking to gain exposure to the cryptocurrency markets, but they also come with significant risks and should be used with caution.

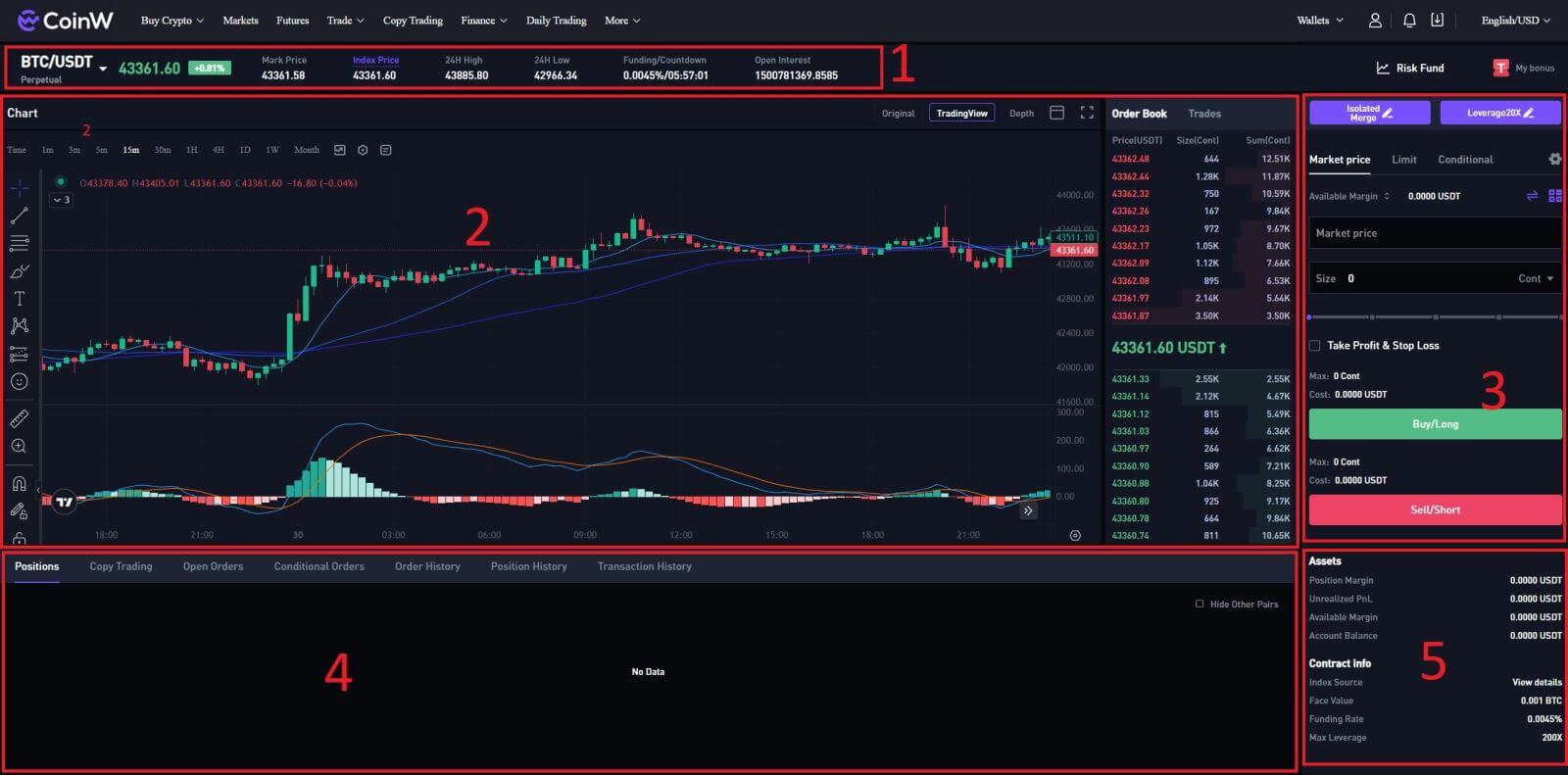

- Trading pair data area

Click “Perpetual” at the left corner on the Futures trading page, and you can select the trading pair according to your personal needs (default is BTC/USDT)

You can view the transaction data of the current trading pair, as well as the real-time funding and the countdown.

- Order book, depth data area

View the K-line chart of the current trading pair, you can select the time unit as needed, and add indicator items

View the current order book

- Order area

This is an area for placing orders and supports the following operations:

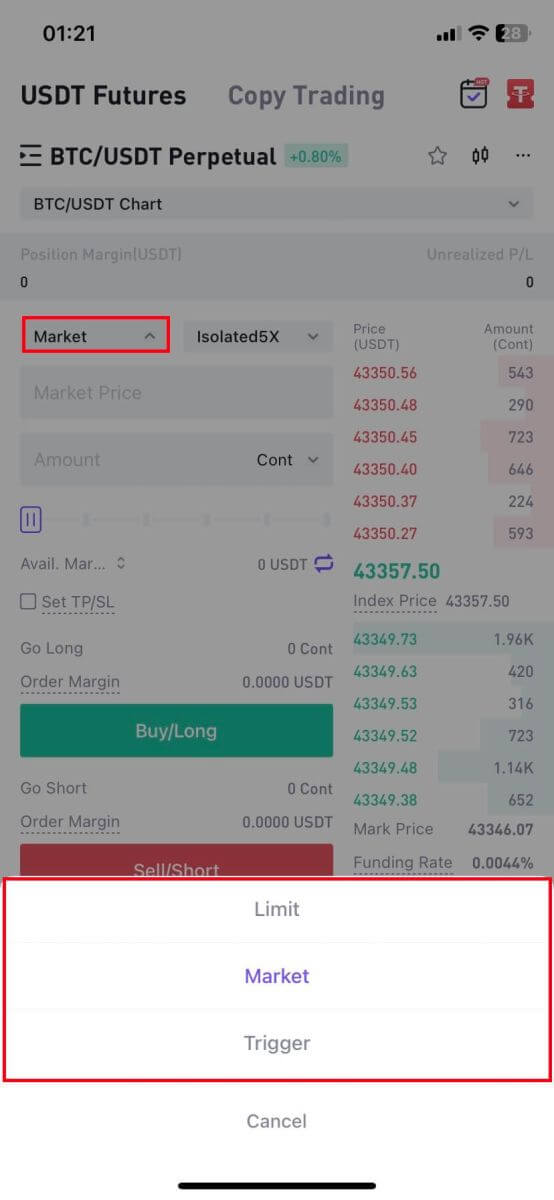

Use different order modes to open positions and place orders (market/limit/trigger)

Take profit and stop loss settings

Assets transfer

Contract calculator

Search and use of Futures Bonus

Preference, position mode, leverage settings

- Position and order details area

Here you can monitor personal trading activities and conduct operations such as closing

Positions: In the list of currently held positions, you can view the size, the opening price, the margin occupied, the expected liquidation price, the unrealized profit and loss, the rate of return, etc.; and you can conduct operations such as setting take profit and stop loss, and the limit/market partially closing, the market fully closing for the position

Open orders: record of limit orders waiting to be filled

Limit orders: a record of pending/un-triggered orders

Order history: record of closed positions in the past (displayed by selecting position mode or order mode)

Statement: You can check the fund flow records of the Futures account, including transfer, transaction fee, capital fee, realized profit and loss, etc.

(There is no corresponding page in the App, but you can check the transaction fee and realized profit and loss in the Order History)

- Margin list and contract information area

You can view the current situation of the Futures account, margin usage, total profit and loss, and contract assets here. In the contract information section, you can view the basic data information of the current trading pairs.

How to Trade BTC/USDT Perpetual Futures on CoinW (Web)

1. Log in to the CoinW website and navigate to the [Futures] section by clicking the tab at the top of the page.

2. On the left-hand side, select BTC/USDT from the list of futures.

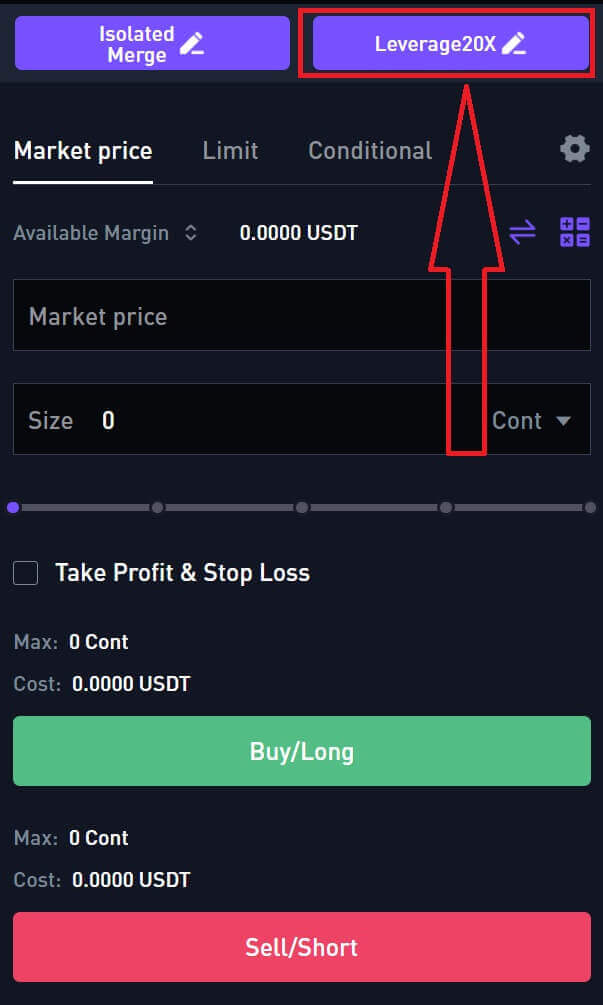

3. Click on [Leverage20X] to continue.

4. Adjust the leverage multiplier by clicking on the number. Different products support varying leverage multiples—please check the specific product details for more information.

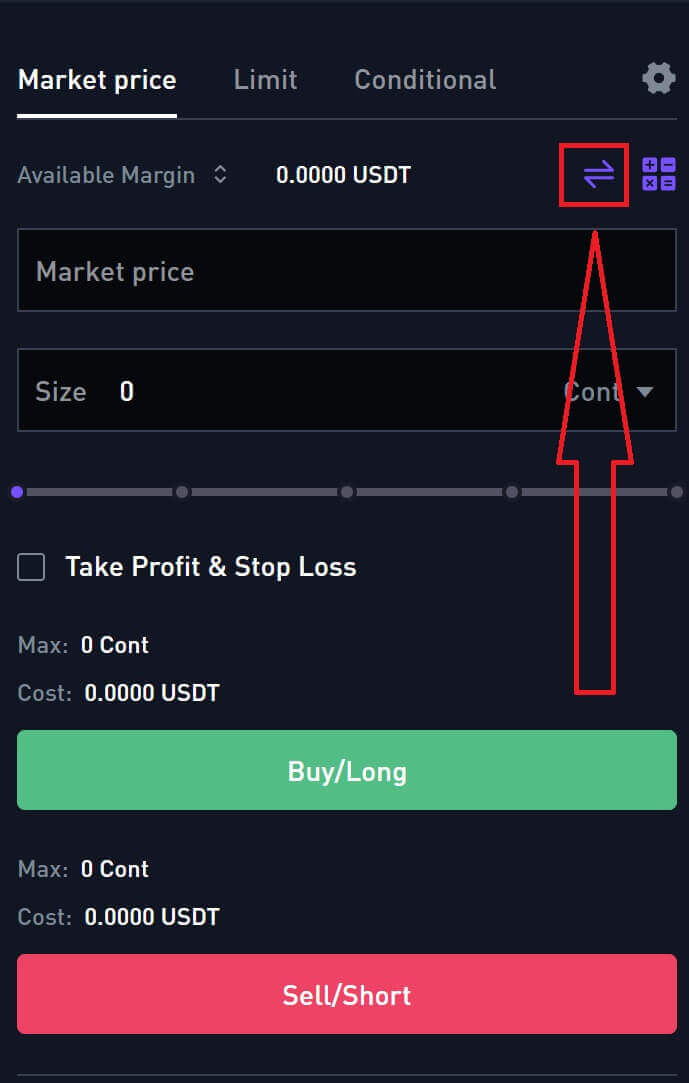

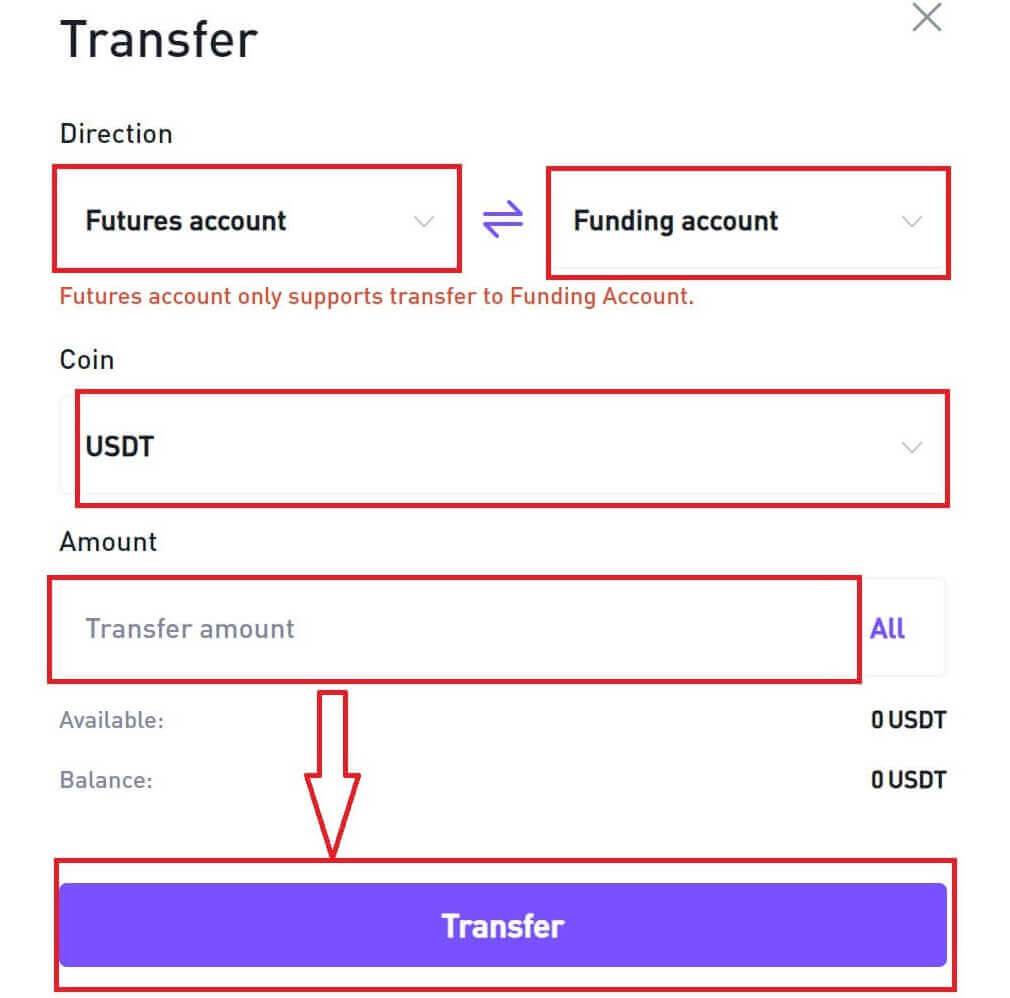

5. Click the small arrow button on the right to access the transfer menu.

6. Enter the desired amount for transferring funds from the spot account to the futures account and click [Transfer] to confirm.

7. To open a position, users can choose between three options: Limit Order, Market price, and Conditional. Enter the order price and quantity and click Open.

- Limit Order: A limit order is an order placed in the order book at a specific limit price. After placing a limit order, when the market price reaches the set limit price, the order will be matched to trade. Therefore, a limit order can be used to buy at a lower price or to sell at a higher price than the current market price. Please note: When the limit order is placed, the system does not accept buying at high prices and selling at low prices. If you buy at high prices and sell at low prices, the transaction will be executed immediately at the market price, and the handling fee will also be calculated at 0.06%.

- Market Price: A market order is an order that trades at the current best price. It is executed against the previously placed limit order in the order book. When placing a market order, you will be charged a taker fee for it.

- Trigger Order: The trigger order sets a trigger price, and when the latest price reaches the trigger price set before, the order will be triggered to enter the order book. Now it supports market trigger orders and limit trigger orders.

- Take Profit and Stop Loss: Take profit and stop loss settings, you can preset the take profit price and stop loss price of a position before opening the position.

8. After placing your order, view it under [Open Orders] at the bottom of the page. You can cancel orders before they’re filled. Once filled, find them under [Position].

9. To close your position, click [Close] under the Operation column.

How to Trade BTC/USDT Perpetual Futures on CoinW (App)

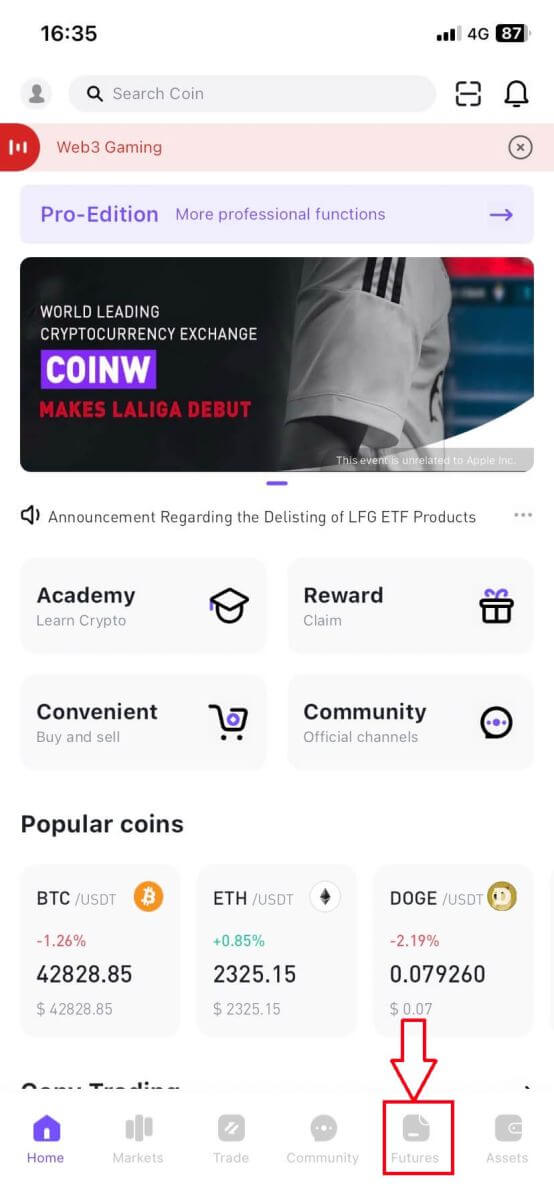

1. Log in to the CoinW app and navigate to the [Futures] section by clicking the tab at the bottom of the home page.

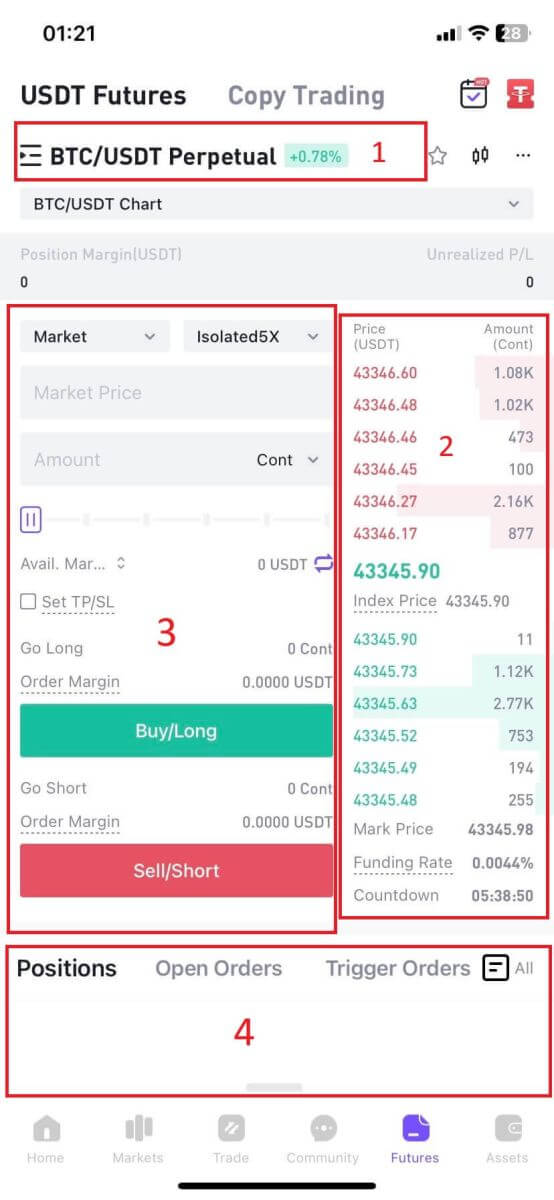

2. Here is the main page of Futures Trading.

- Trading pair data area

Shows the current contract underlying cryptos with the current increase/decrease rate. Users can click here to switch to other varieties.

- Order book, Transaction Data

Display current order book and real-time transaction order information.

- Operation panel

Allow users to make fund transfers and place orders.

- Position and order details area

Here you can monitor personal trading activities and conduct operations such as closing

Positions: In the list of currently held positions, you can view the size, the opening price, the margin occupied, the expected liquidation price, the unrealized profit and loss, the rate of return, etc.; and you can conduct operations such as setting take profit and stop loss, and the limit/market partially closing, the market fully closing for the position

Open orders: record of limit orders waiting to be filled

Trigger orders: a record of pending/un-triggered orders

Order history: record of closed positions in the past (displayed by selecting position mode or order mode)

Statement: You can check the fund flow records of the Futures account, including transfer, transaction fee, capital fee, realized profit and loss, etc.

(There is no corresponding page in the App, but you can check the transaction fee and realized profit and loss in the Order History)

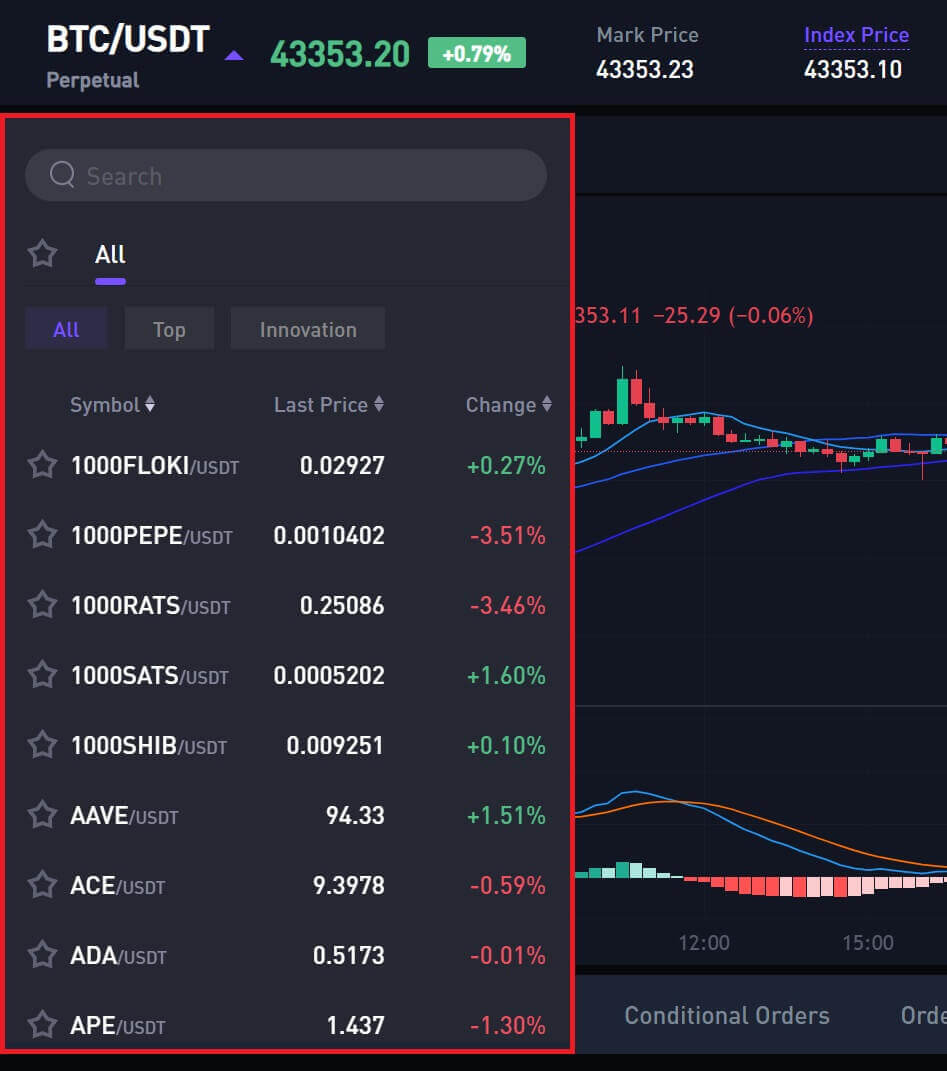

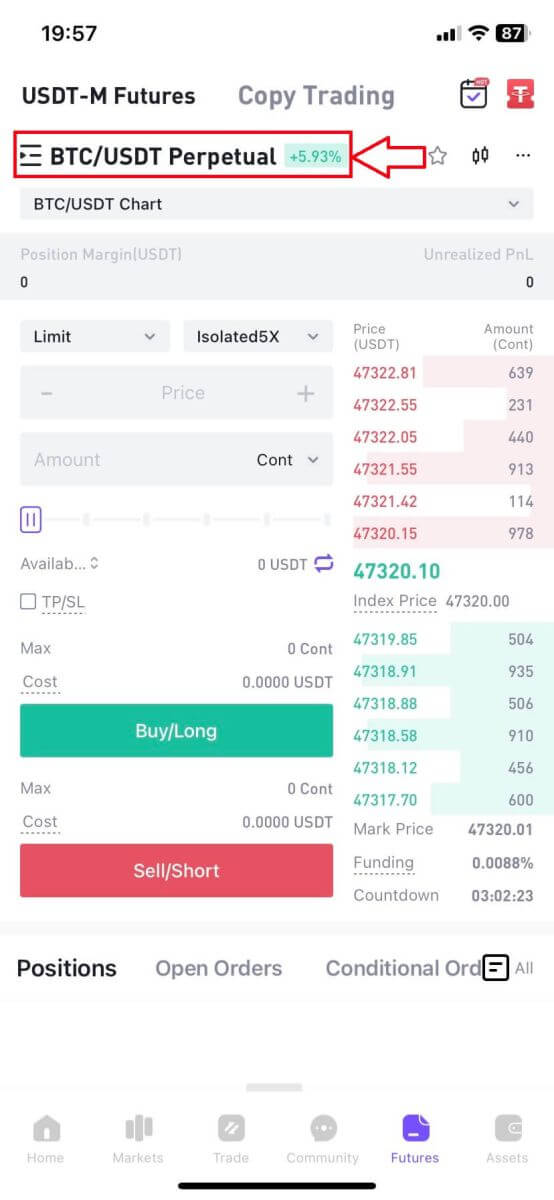

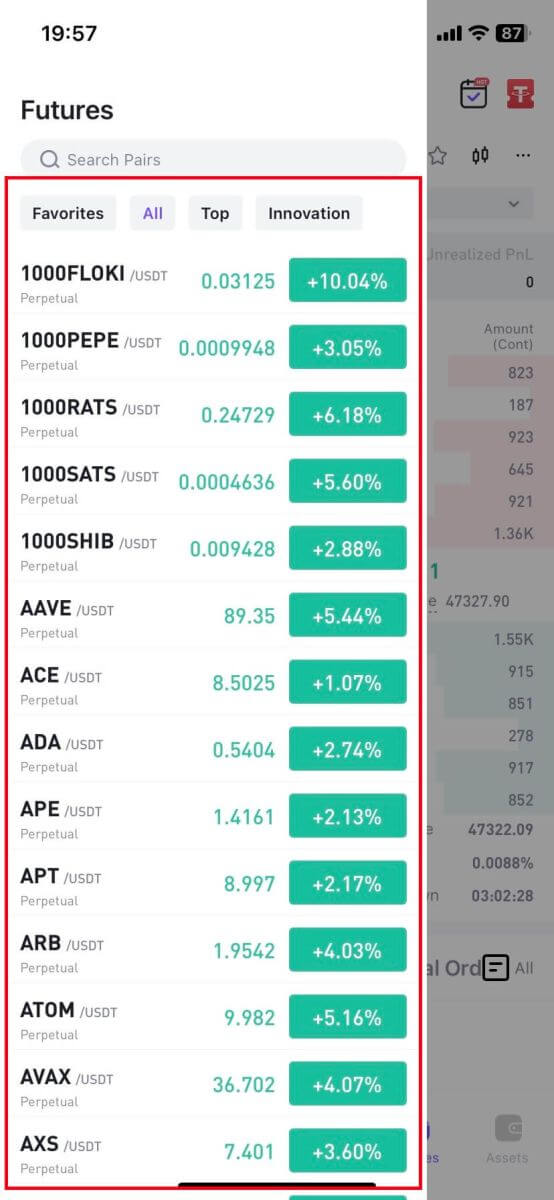

3. Tap on BTC/USDT situated at the top left to switch between different trading pairs. Utilize the search bar or directly select from the listed options to find the desired futures for trading.

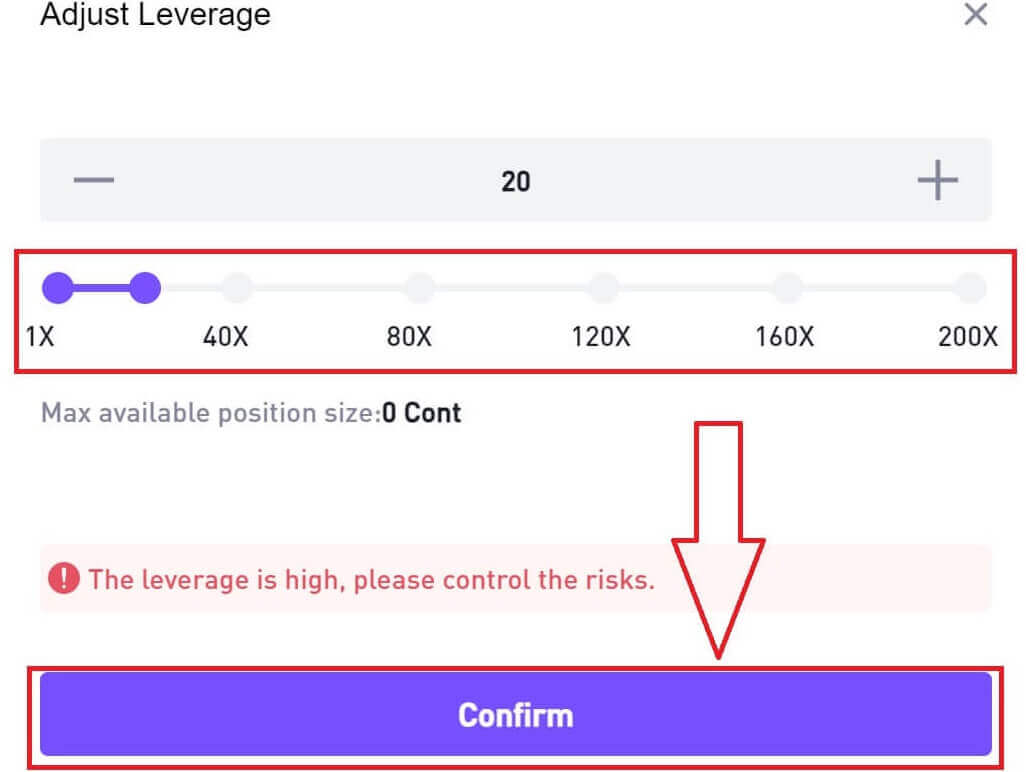

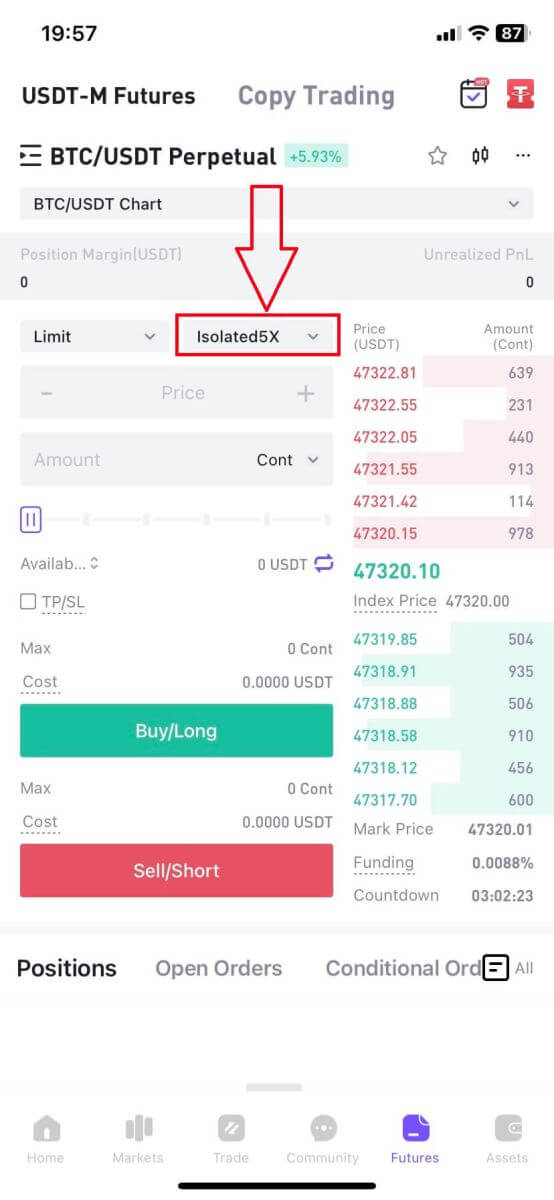

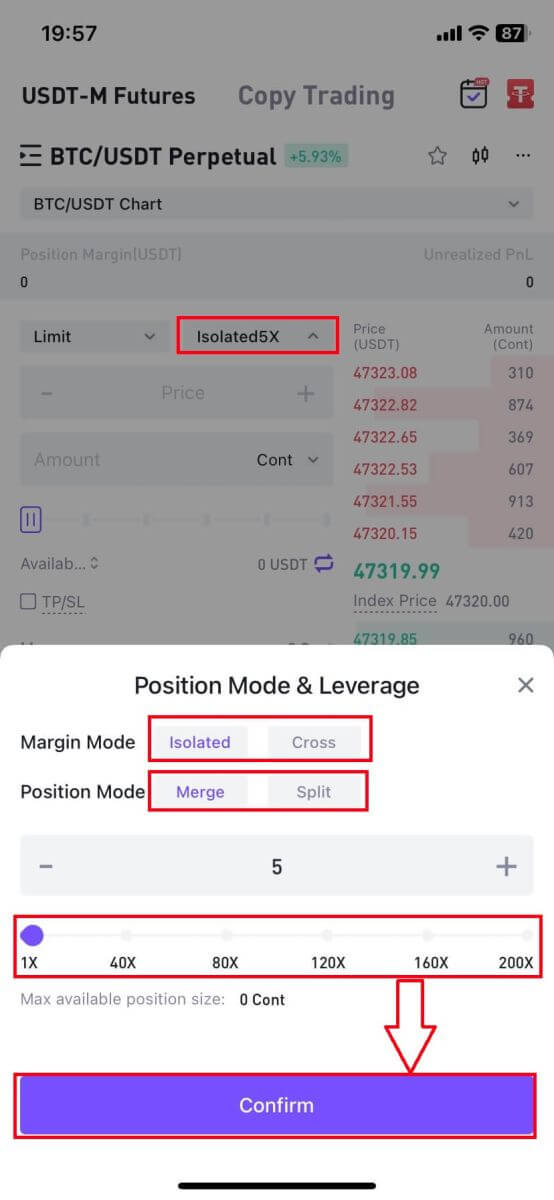

4. Choose the margin, and position mode and adjust the leverage settings according to your preference. Click [Confirm] to continue.

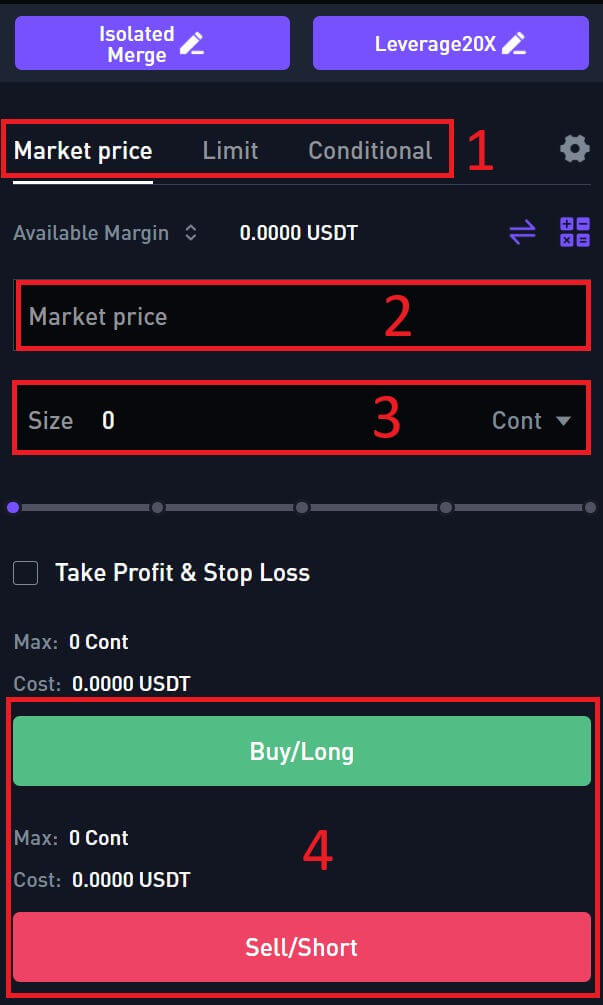

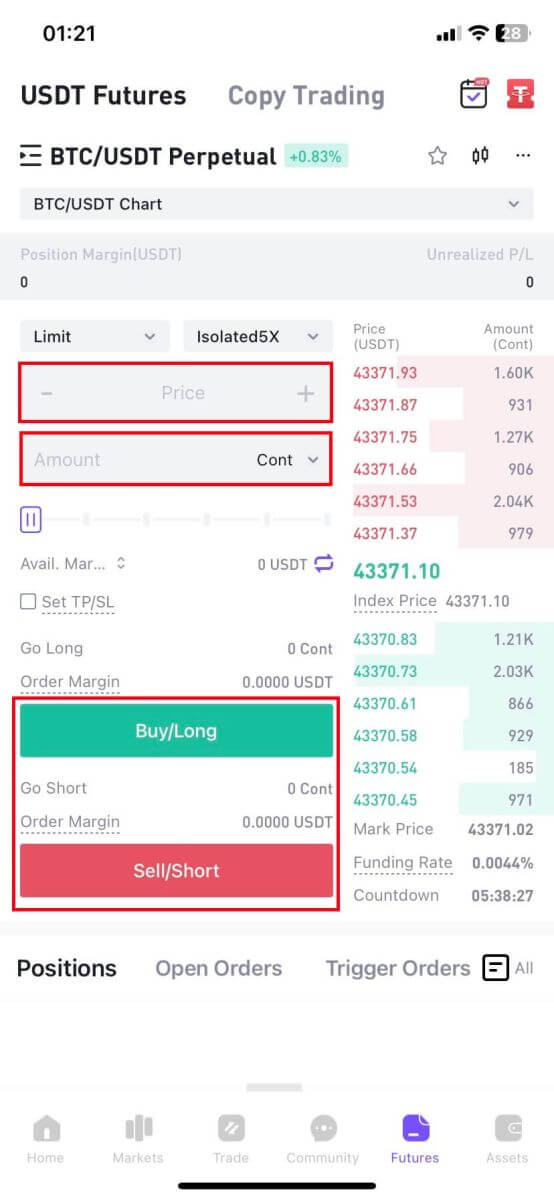

5. On the right side of the screen, place your order Tap on the [Market] to switch to Limit order.

6. For a limit order, enter the price and amount, for a market order, input only the amount. Tap [Buy/Long] to initiate a long position or [Sell/Short] for a short position.

7. Once the order is placed, if it isn’t filled immediately, it will appear in [Open Orders]. Users have the option to tap [Cancel] to revoke pending orders. Fulfilled orders will be located under [Positions].

8. Under [Positions] tap [Close] then enter the price and amount required to close a position.

Frequently Asked Questions (FAQ)

Differences Between Spot Trading and Futures Trading

- Conceptual Differences:

Spot Trading:

In the Spot market, you buy and sell cryptocurrency with instant delivery, and you own the assets immediately after the order is filled.

Futures Trading:

In the Futures market, a position opened is a Futures contract representing the value of a specific cryptocurrency. When it is opened, you do not own the underlying cryptocurrency, but a contract that you agree to buy or sell a specific cryptocurrency at some point in the future.

For example: If you buy BTC with USDT in the spot market, the BTC you buy will be displayed in the asset list in your account, which means that you already own and hold the BTC;

In the contract market, if you open a long BTC position with USDT, the BTC you buy will not be displayed in your Futures account, it only displays the position which means you have the right to sell the BTC in the future to get profit or loss.

- Leverage

Leverage makes contract trading extremely capital-efficient. When doing contract trading, you only need to invest a small part of 1BTC to open a contract position of a whole 1BTC. In contrast, spot trading does not offer leverage. For example, the current market price of 1BTC=30000USDT, if you want to buy 1 BTC in the spot market, you need to spend 30000USDT, but in the contract market, if you open 100 times leverage, you only need to invest 300USDT to get a 1BTC long position.

- Flexibility to Choose Long or Short

If you hold USDT on the spot, all you can do is buy currencies. When the market is falling, buying is not profitable;

However, in the contract, if you hold USDT, you can choose to go long or short according to the market conditions. When the market is falling, you can choose to go short to make a profit. When the market is rising, you can choose to go long and make a profit.

Differences Between Traditional Contracts and Perpetual Contracts

- Traditional Contract:

A traditional contract, also a futures contract, is an agreement to buy or sell a commodity, currency, or other financial asset at a predetermined price at a specific time in the future. Trades in the contract market are not immediately settled. In addition, users cannot directly buy and sell physical commodities or digital assets in the contract market. Instead, they trade contracts representing those assets, and the actual transaction of the asset (or cash) will take place in the future when the contract is executed.

- Perpetual Contract:

A perpetual contract is a special type of futures contract. Unlike traditional contracts, perpetual contracts have no expiry date, and users can choose to keep their positions on the condition that there is forced liquidation caused by loss or manual liquidation.

Roles of Contract Trading

- Hedging and Risk Management: this is the main reason for the birth of futures contracts. To lock the income and cost and hedge the risk of sharp fluctuations in spot prices, companies or individuals engaged in commodity trading will place short orders (long orders) of the same position in the futures market to protect against risks;

- Short-term exposure: traders can bet on the performance of an asset even if they do not own it;

- Leverage: traders can open positions larger than their account balance.

What Is Funding and How to Check It

Funding ensures that the price of the perpetual contract is as close as possible to the (spot) price of the underlying asset. In essence, traders "pay each other" based on their positions, and the difference between the perpetual contract price and the spot price will determine which party gets profits.

When the funding is positive, the long party pays to the short party, when negative, the short party pays to the long party.

This means that depending on the funding rate and your open positions, you end up either on the side paying or on the side receiving funding. On the CoinW Futures trading platform, funds are paid every 8 hours. On the web, you can view it at the top of the K-line chart on the Futures trading page, and on the app, you can view it at the bottom of the order book on the Futures page. The funding displayed are real-time, and the web supports viewing the remaining time of the next funding cycle (Countdown).

Differences Between Isolated and Cross

- Cross: The balance of the Futures account is all used as a margin. When a position is liquidated, it will affect the whole balance of the account.

- Isolated: The margin allocated to a position is limited to a certain amount. When the position is liquidated, only the margin allocated to the position will be affected, and the remaining will not be affected.

Note: The cross/isolated mode switch can only be available when there are no unfulfilled orders or open positions; if there are, please close and cancel it before switching the cross/isolated mode.

Split/Merge

- Merge: After placing an additional order, it will merge to the position of the same trading pair and the same direction and be displayed together. The opening price is the average opening price, and the margin and estimated liquidation price will change accordingly.

- Split: After placing an additional order, it will split from the position of the same trading pair and the same direction and be displayed independently. Each has its own opening price, margin, and estimated liquidation price

Note: The split/merge mode switch can only be available when there are no unfulfilled orders or open positions; if there are, please close and cancel it before switching to the cross/isolated mode.

When Will the Position Be Liquidated Forcibly?

When the margin allocated is insufficient to maintain the existing position, the position will be liquidated forcibly. Margin balances include unrealized profits and losses. That is, the change in your profit or loss will cause a change in the margin balance. If the position is in cross mode, the unrealized profit will be added to the contract balance as the margin for all positions; if in the isolated mode, the balance can be allocated to each position.

You can check the risk rate of the current position and the estimated liquidation price in the position. Please add enough margin in time before the forced liquidation is triggered.