CoinW Demo Account

How to Register on CoinW

How to Register on CoinW with Phone Number or Email

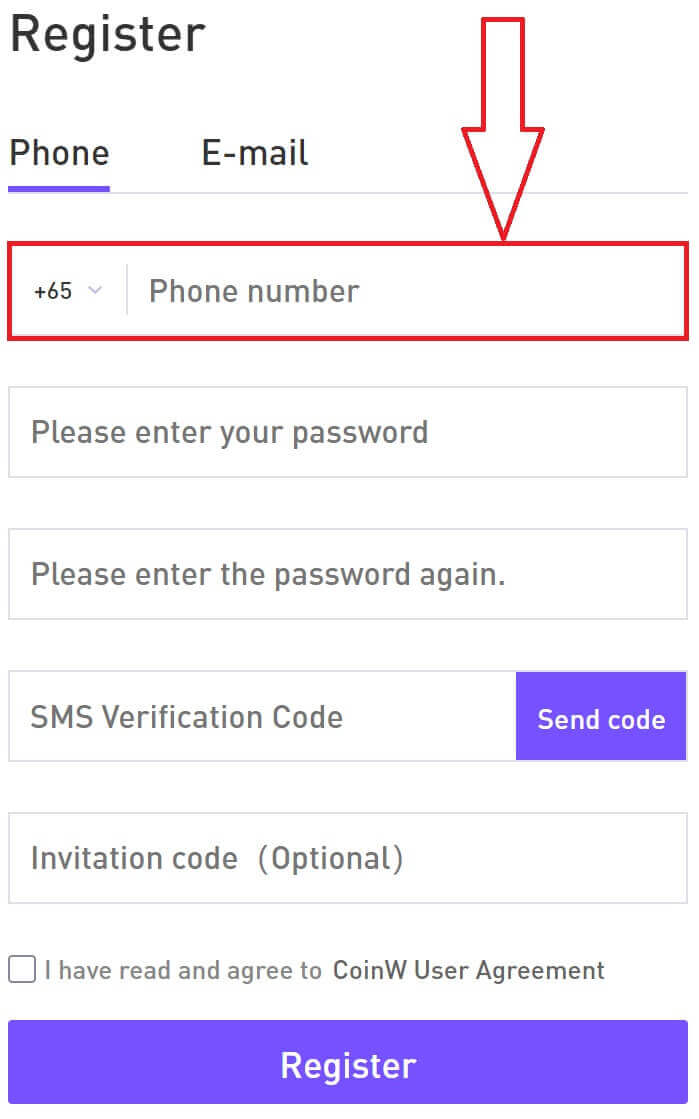

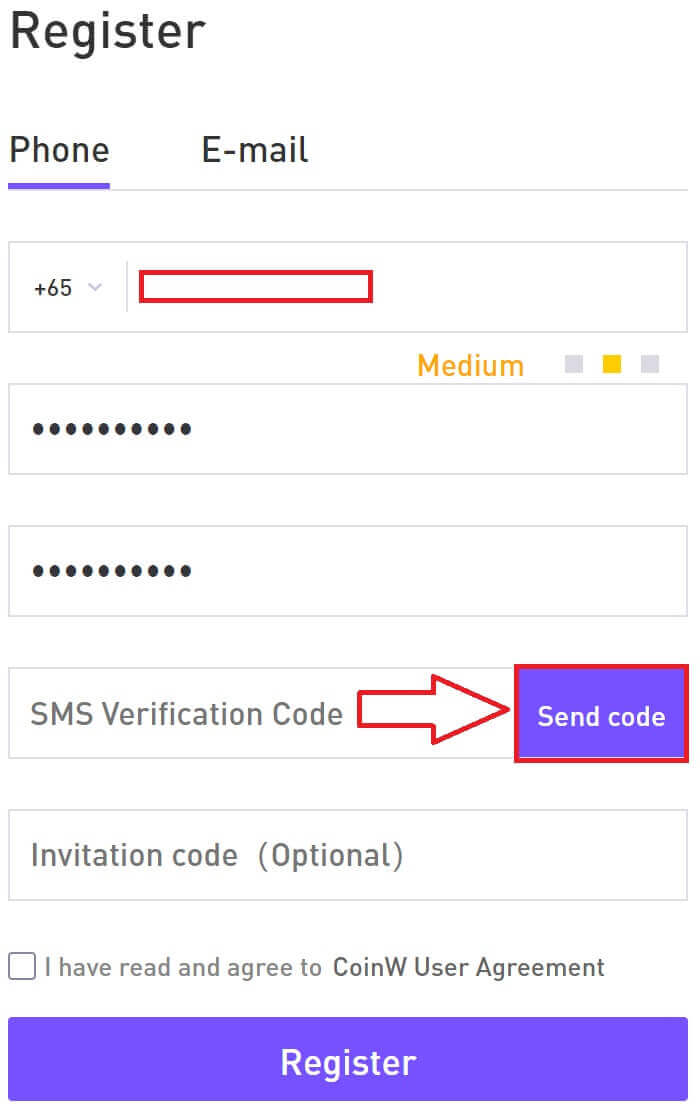

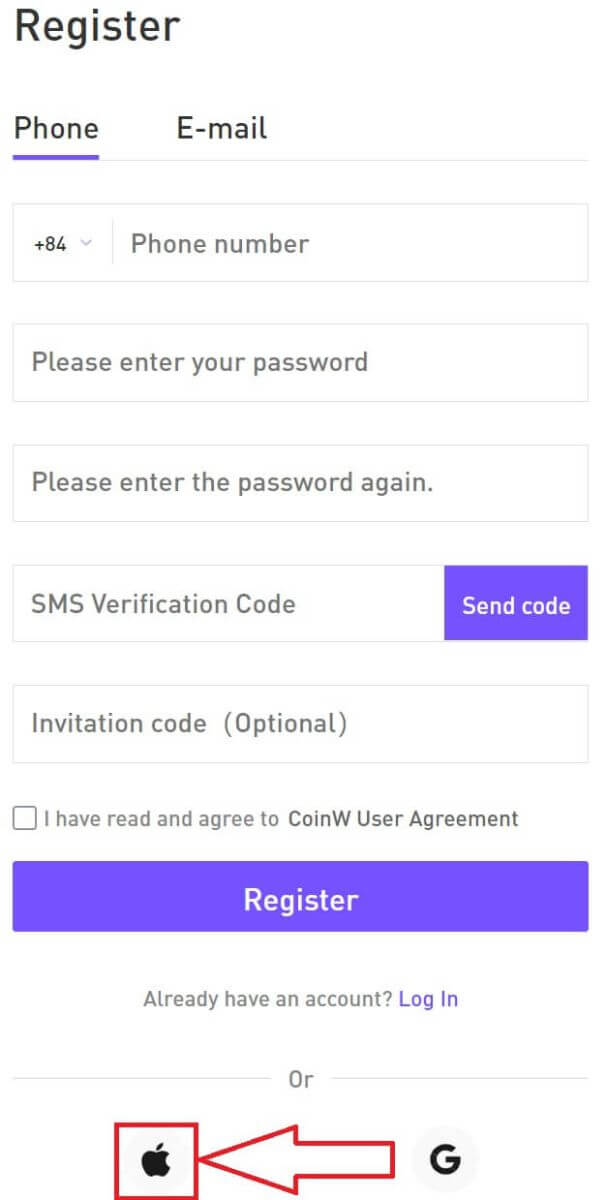

By Phone Number

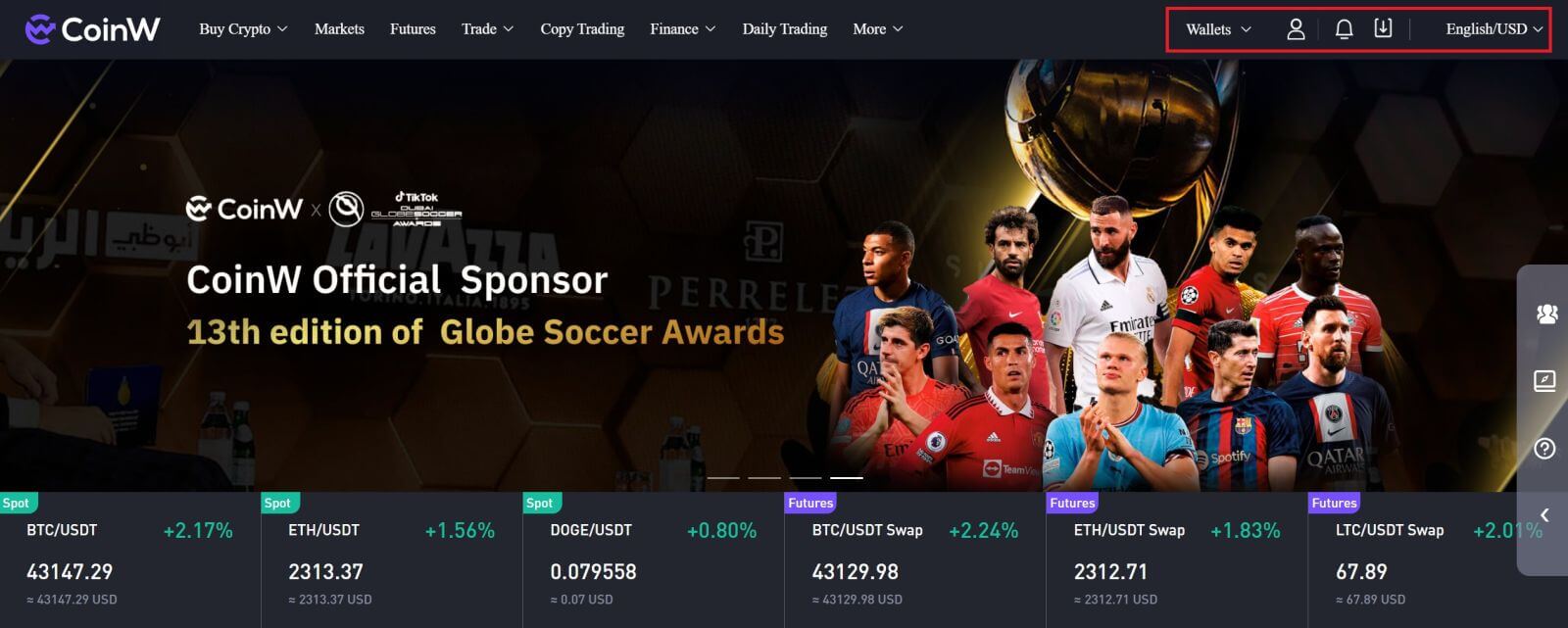

1. Go to CoinW and click [Register].

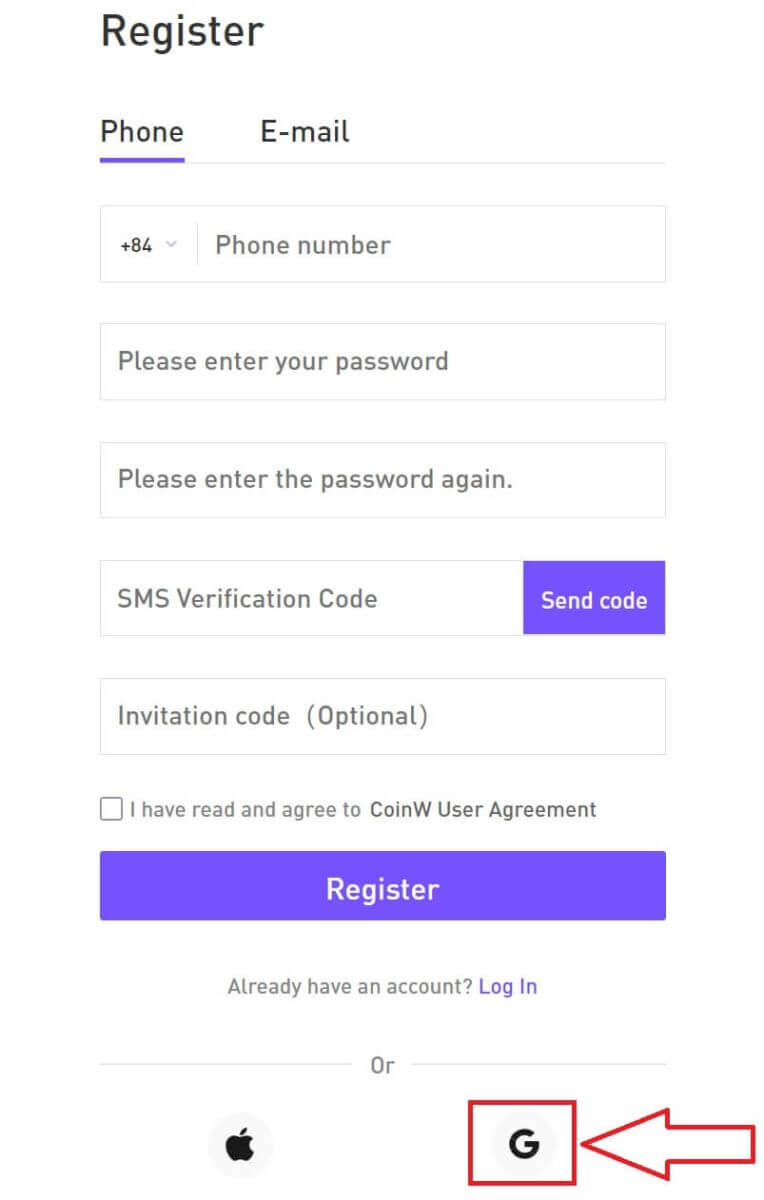

2. Select a registration method. You can sign up with your email address, phone number, and Apple or Google account. Please select the type of account carefully. Once registered, you cannot change the account type. Select [Phone] and enter your phone number.

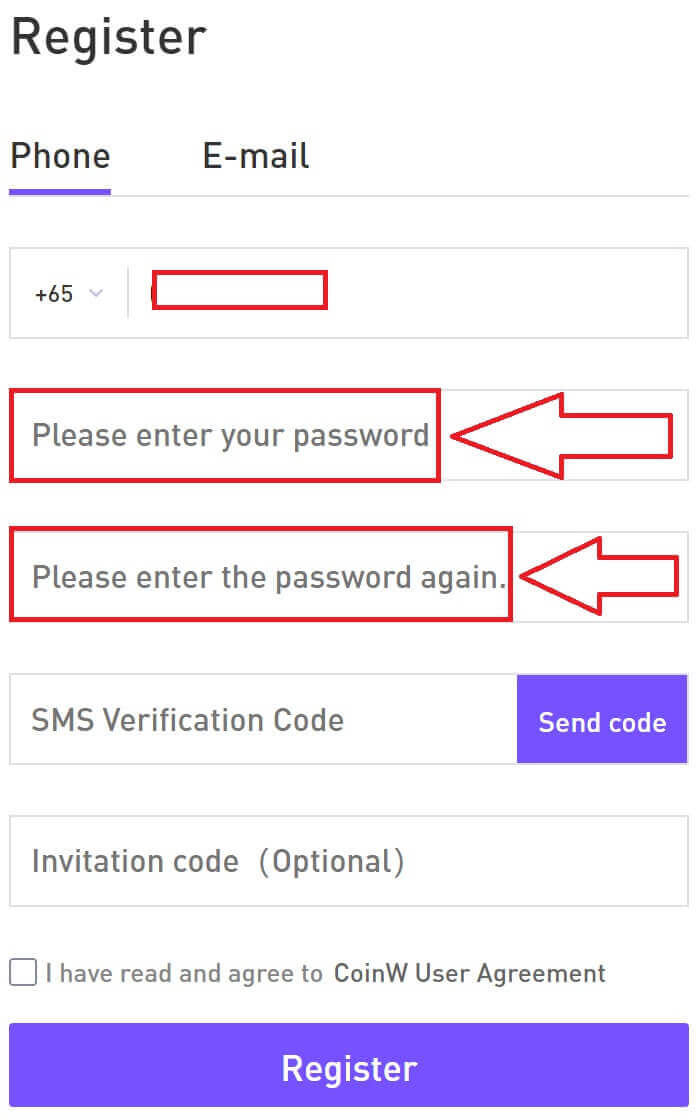

3. Then, create a secure password for your account. Make sure to verify it twice.

4. After typing all the information, click on [Send code] to receive an SMS Verification Code.

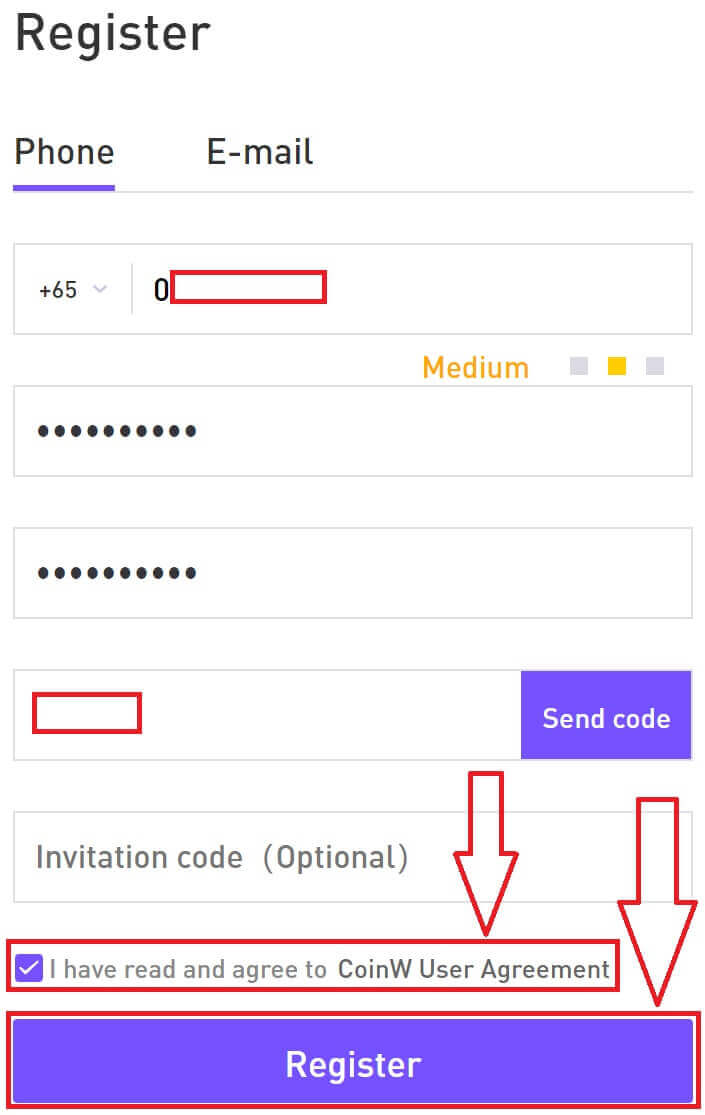

5. Click on [Click to verify] and do the process to prove that you are a human.

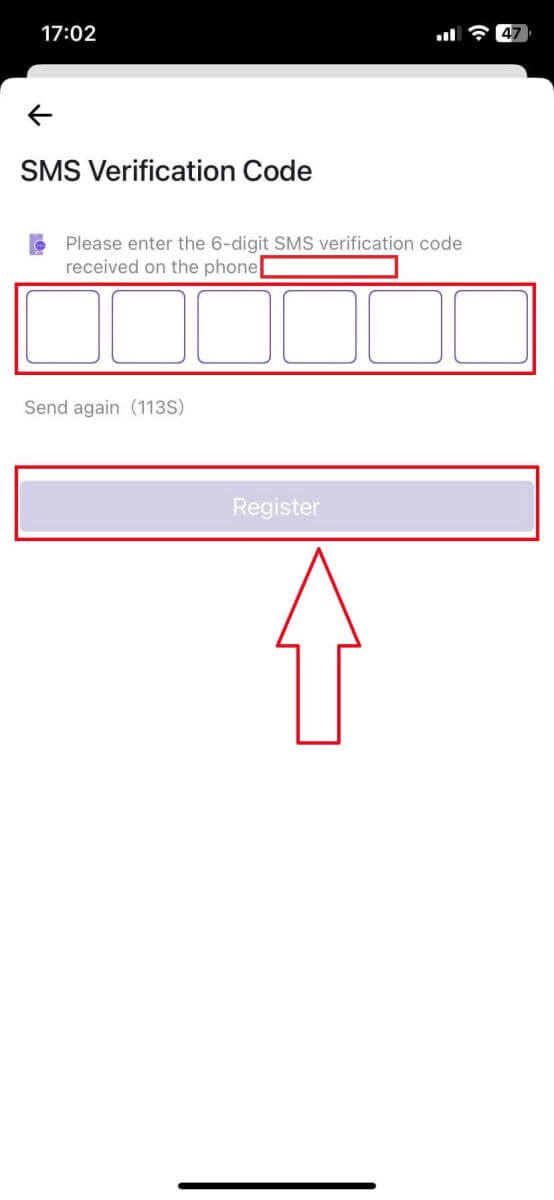

6. You will receive a 6-digit verification code on your phone. Enter the code within 2 minutes, tick on the box [I have read and agree to CoinW User Agreement], then click [Register].

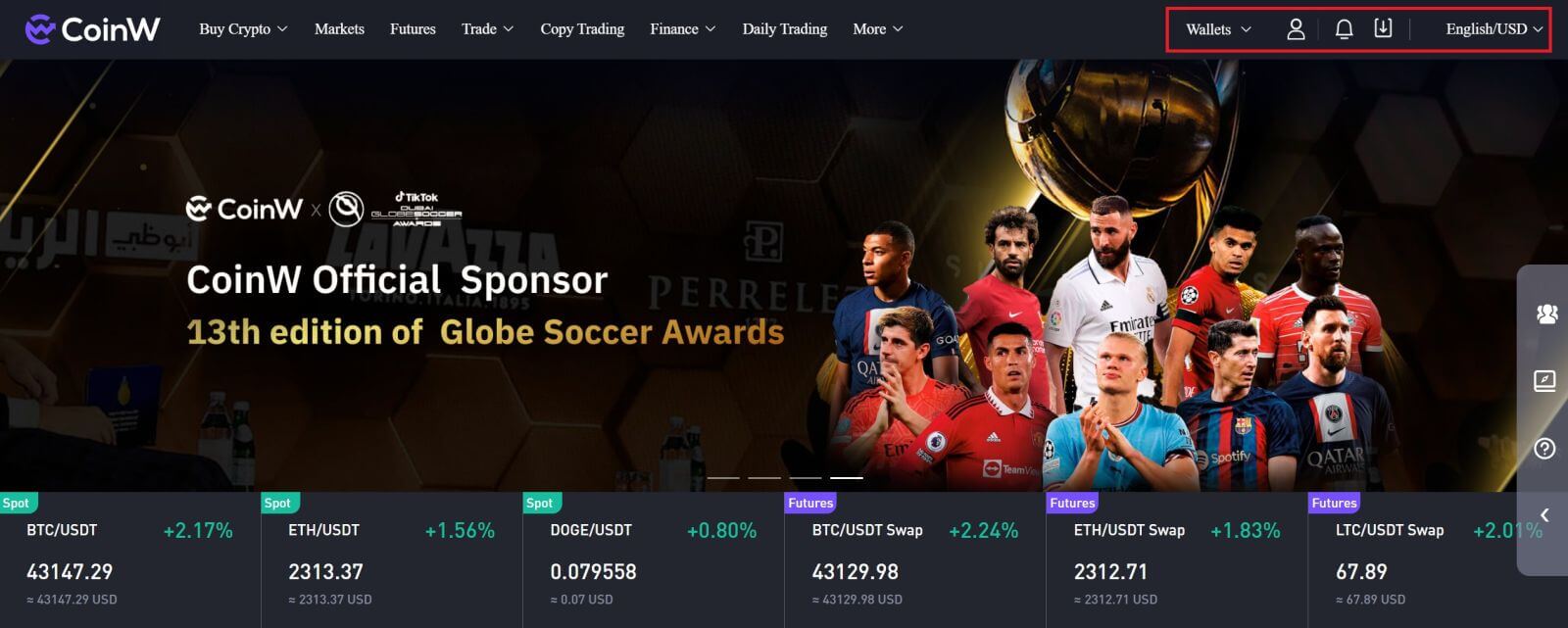

7. Congratulations, you have successfully registered on CoinW.

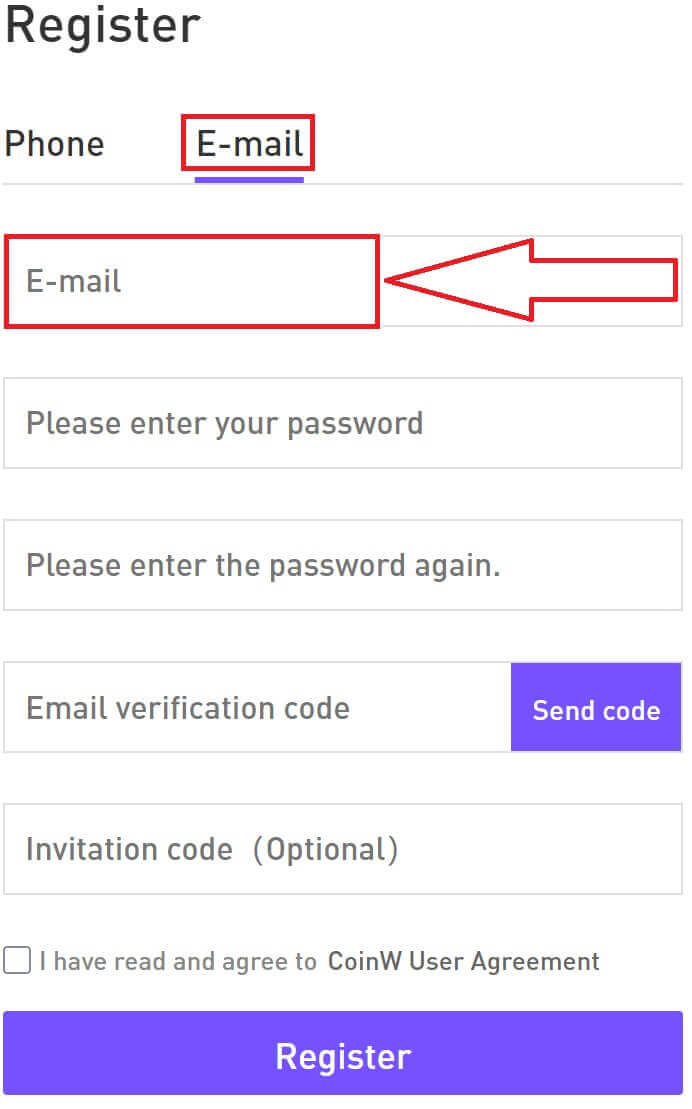

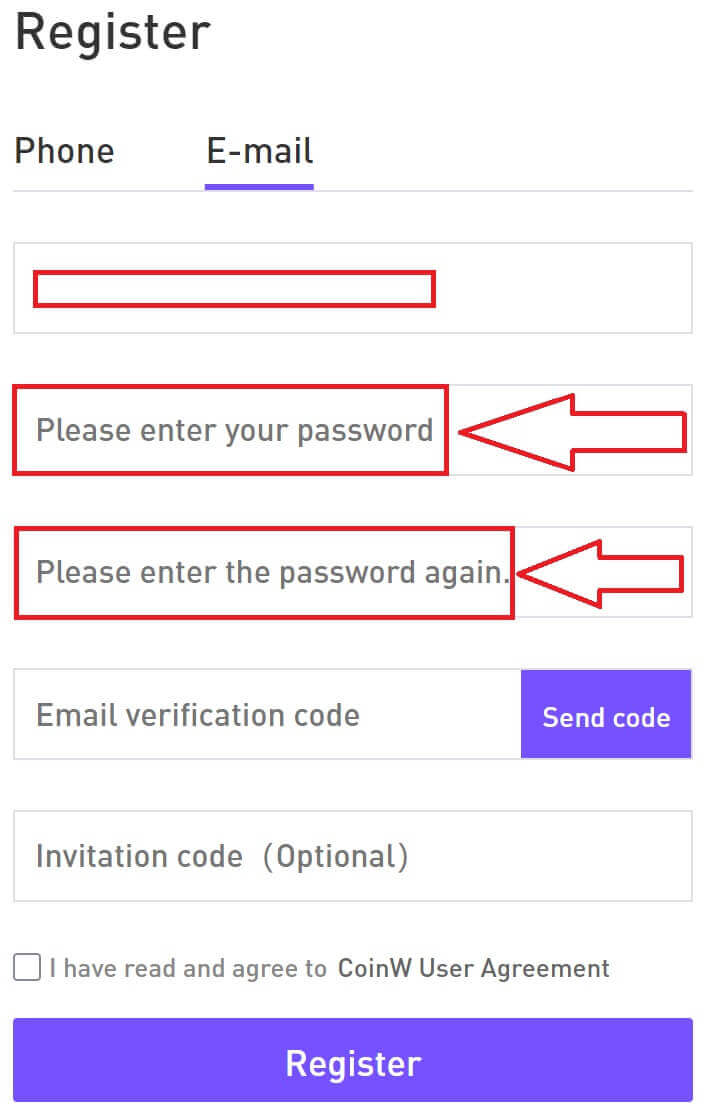

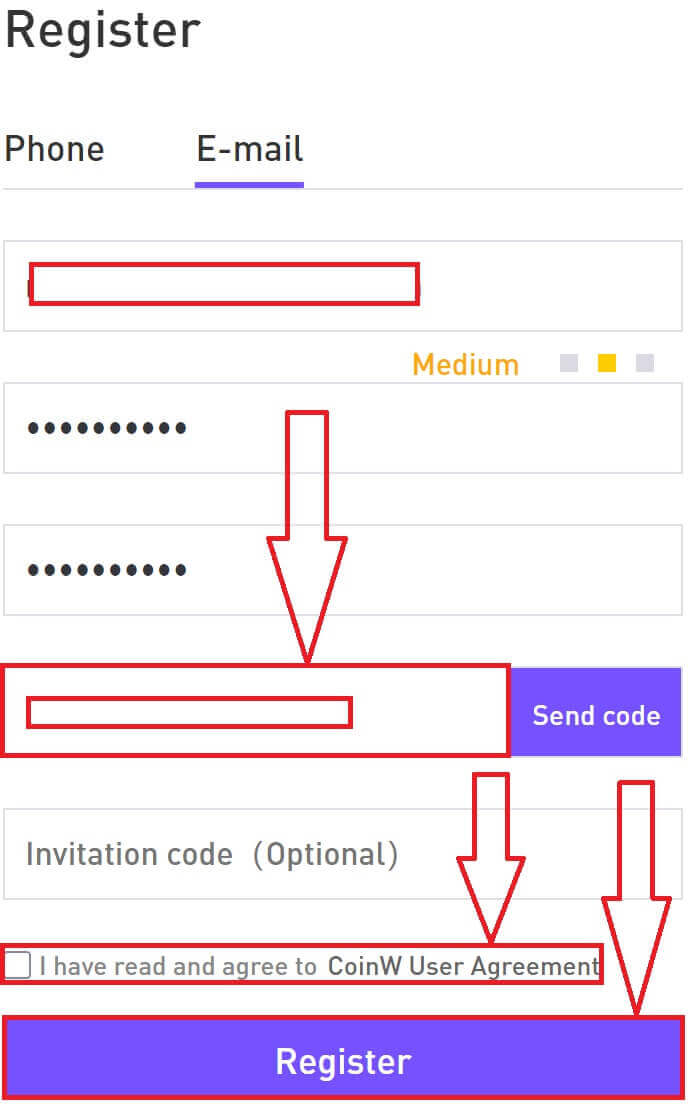

By Email

1. Go to CoinW and click [Register].

2. Select a registration method. You can sign up with your email address, phone number, and Apple or Google account. Please select the type of account carefully. Once registered, you cannot change the account type. Select [Email] and enter your email address.

3. Then, create a secure password for your account. Make sure to verify it twice.

4. After typing all the information, click on [Send code] to receive an Email Verification Code. You will receive a 6-digit verification code in your email box. Enter the code within 2 minutes, tick on the box [I have read and agree to CoinW User Agreement], then click [Register].

5. Congratulations, you have successfully registered on CoinW.

How to Register on CoinW with Apple

1. Alternatively, you can sign up using Single Sign-On with your Apple account by visiting CoinW and clicking [Register].

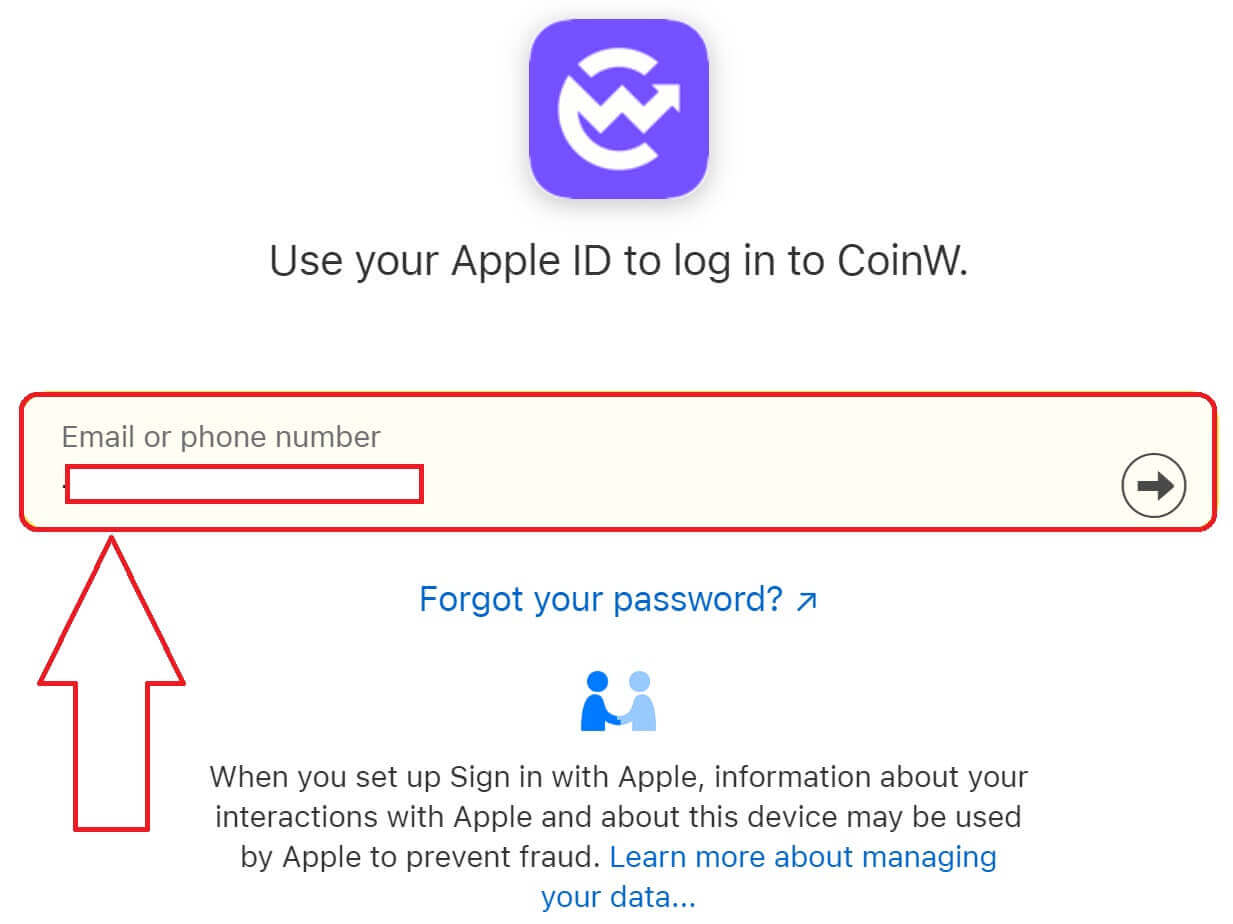

2. A pop-up window will appear, click on the Apple icon, and you will be prompted to sign in to CoinW using your Apple account.

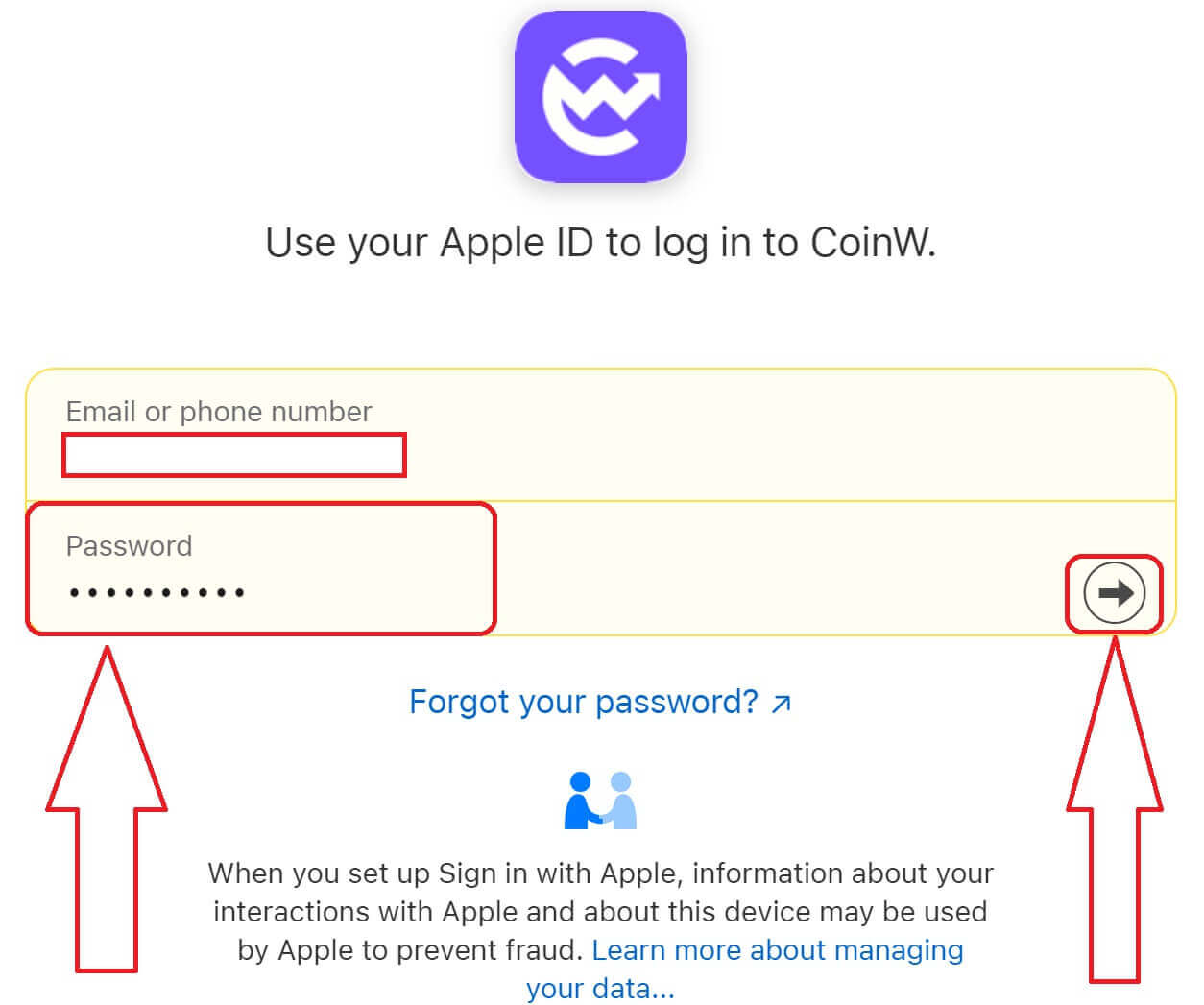

3. Enter your Apple ID and password to sign in to CoinW.

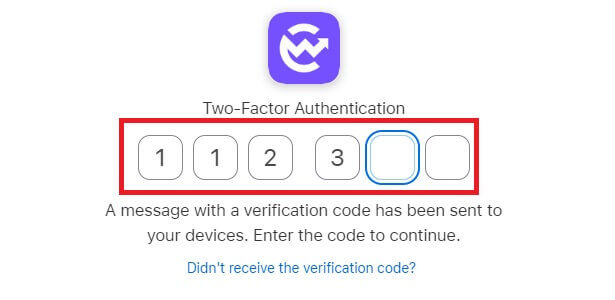

4. After entering your Apple ID and password, a message with a verification code will be sent to your devices, type it in.

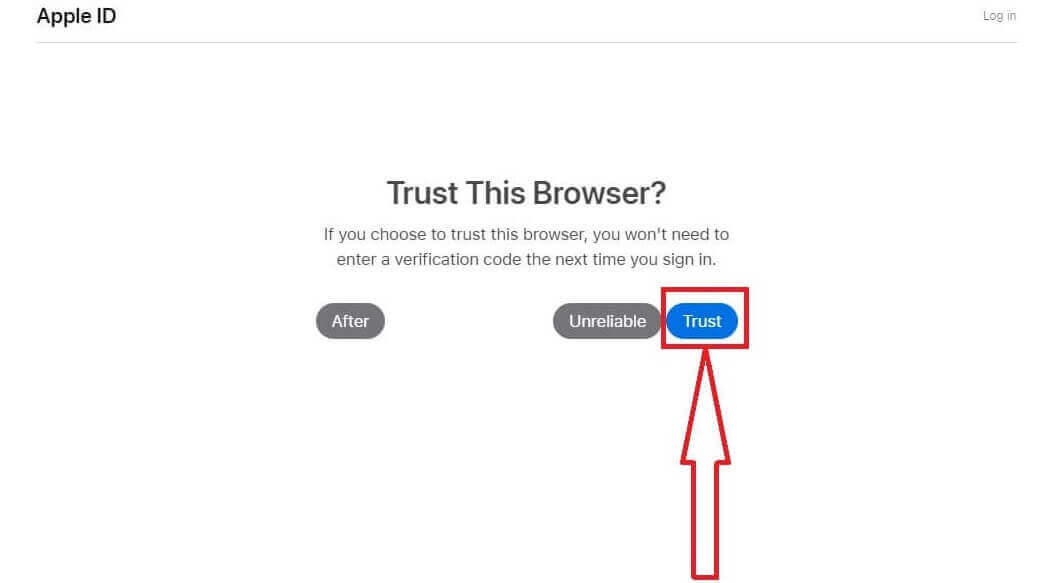

5. Click on [Trust] to continue.

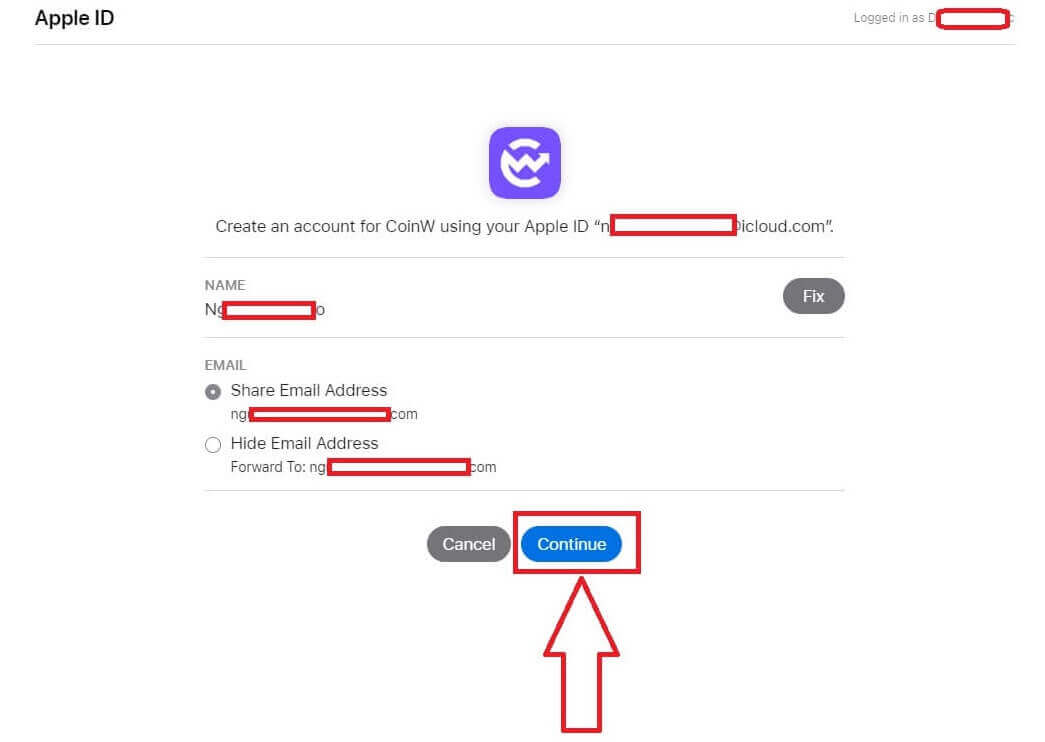

6. Click on [Continue] to move on to the next step.

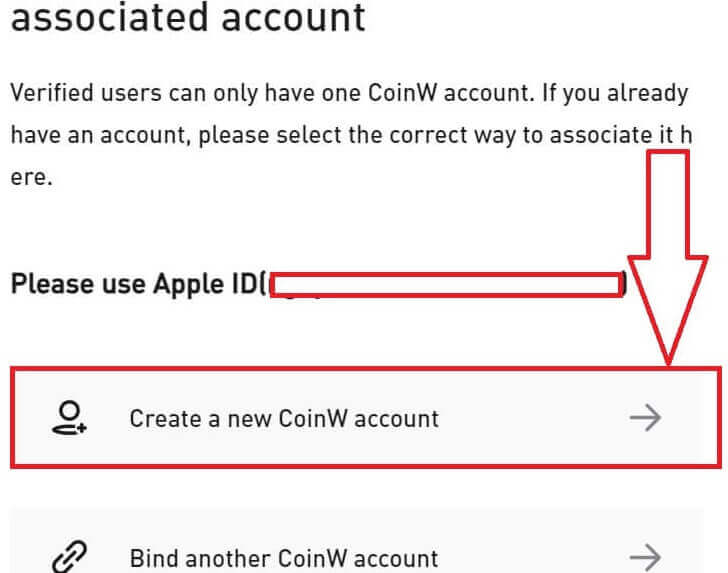

7. Choose [Create a new CoinW account].

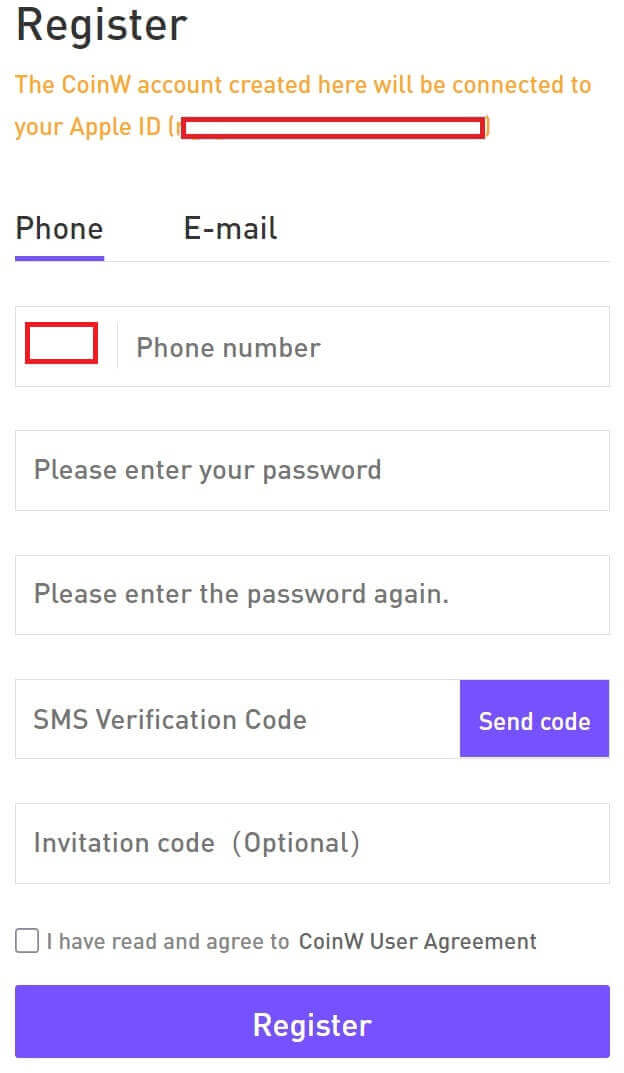

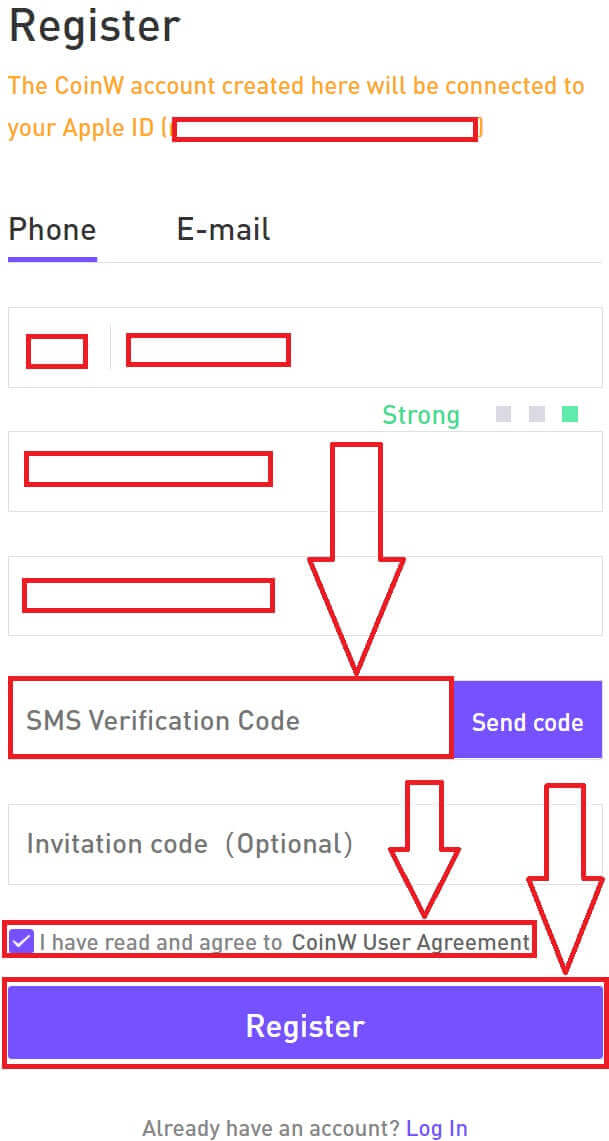

8. Now, the CoinW account created here by both Phone/Email will be linked to your Apple ID.

9. Continue to fill out your information, then click on [Send Code] to receive a verification code then type in [SMS Verification Code]/[Email Verification Code]. After that, click on [Register] to finish the process. Don’t forget to tick the box that you have agreed with CoinW User Agreement.

10. Congratulations, you have successfully registered on CoinW.

How to Register on CoinW with Google

1. Alternatively, you can sign up using Single Sign-On with your Google account by visiting CoinW and clicking [Register].

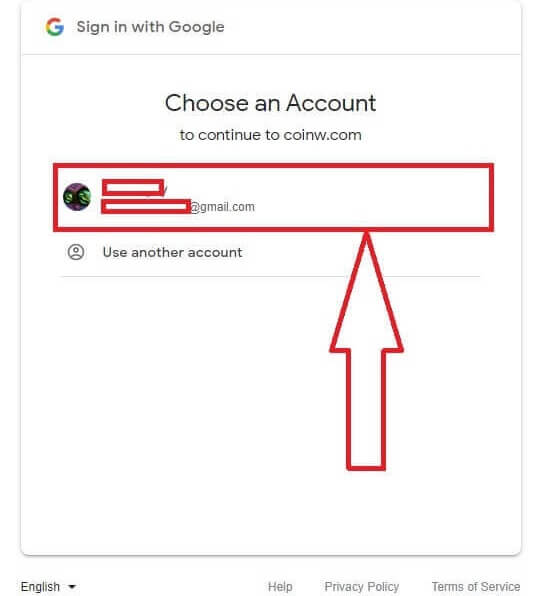

2. A pop-up window will appear, select the Google icon, and you will be prompted to sign in to CoinW using your Google account.

3. Choose the account you want to use to register or log in to your own account of Google.

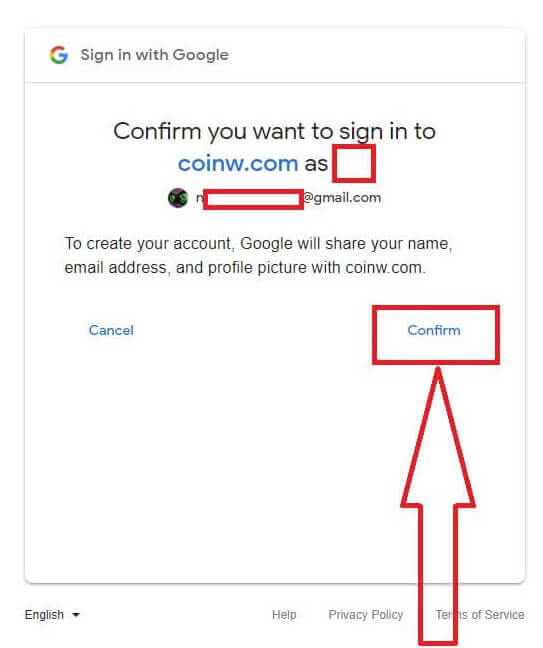

4. Click on [Confirm] to continue.

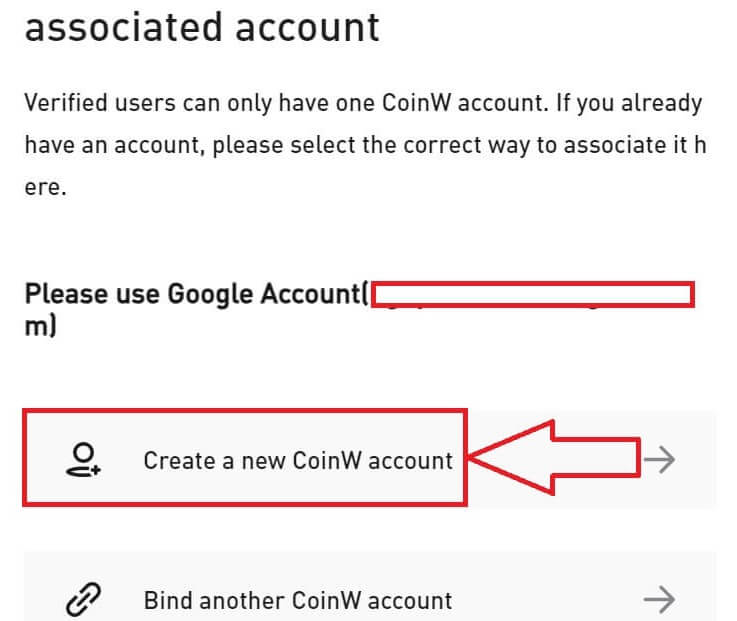

5. Choose [Create a new CoinW account].

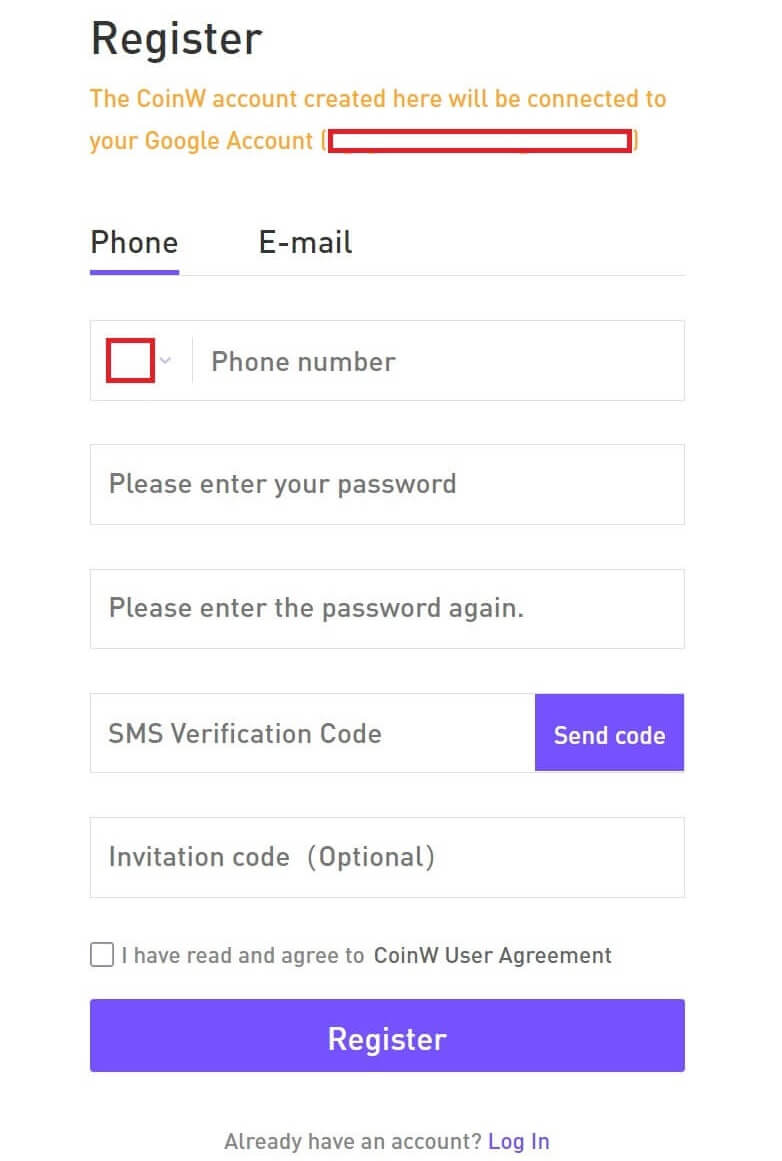

6. Now, the CoinW account created here by both Phone/Email will be linked to your Google account.

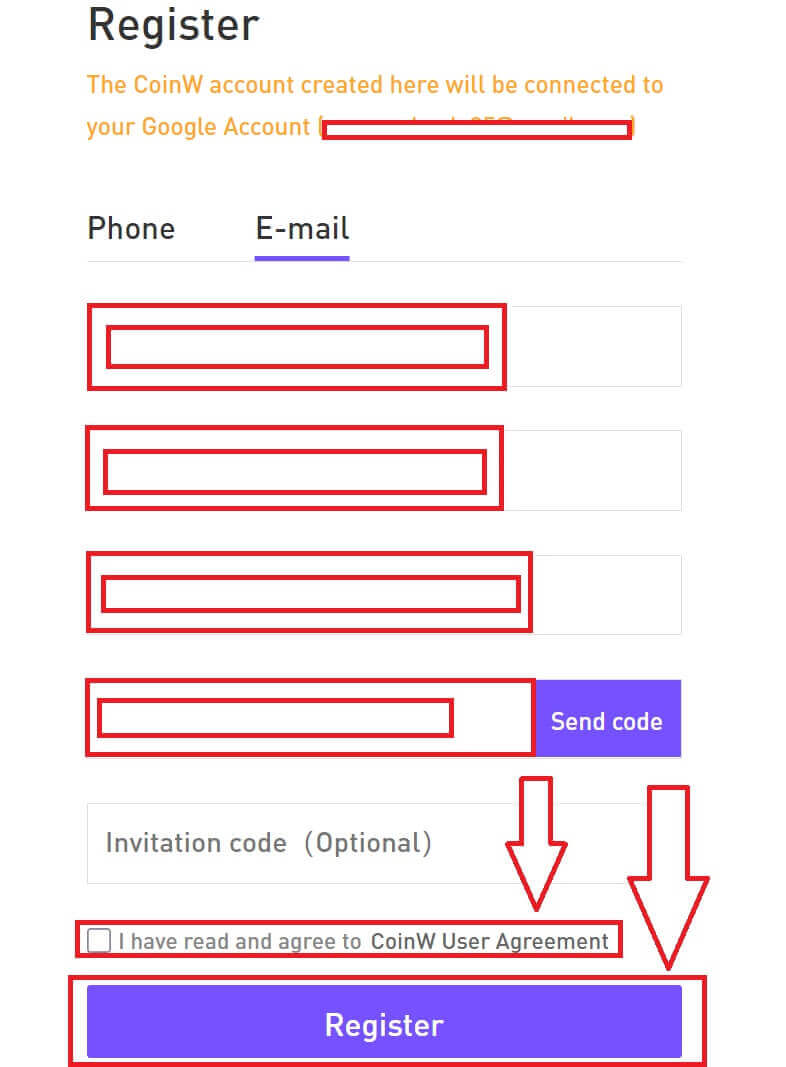

7. Continue to fill out your information, then click on [Send Code] to receive a verification code then type in [SMS Verification Code]/[Email Verification Code]. After that, click on [Register] to finish the process. Don’t forget to tick the box that you have agreed with CoinW User Agreement.

8. Congratulations, you have successfully registered on CoinW.

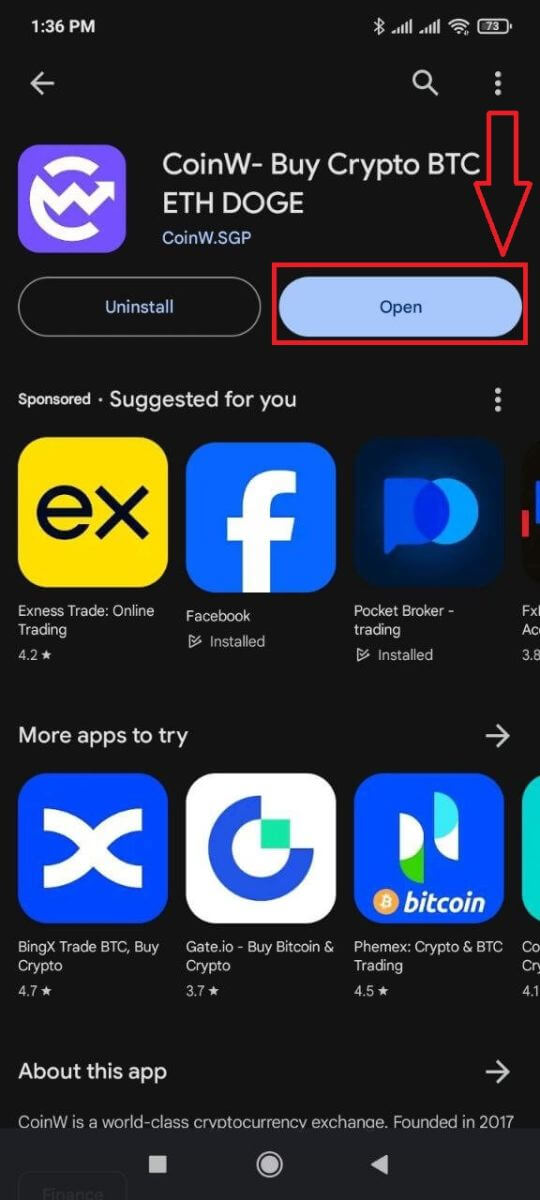

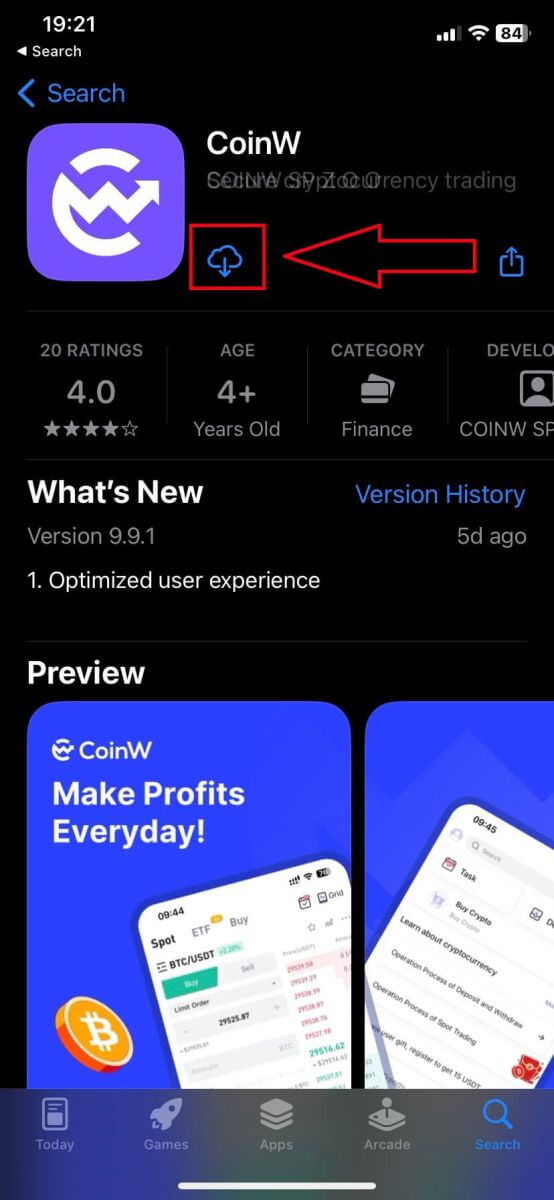

How to Register on CoinW App

The application can be downloaded through the Google Play Store or App Store on your device. In the search window, just enter BloFin and click «Install».

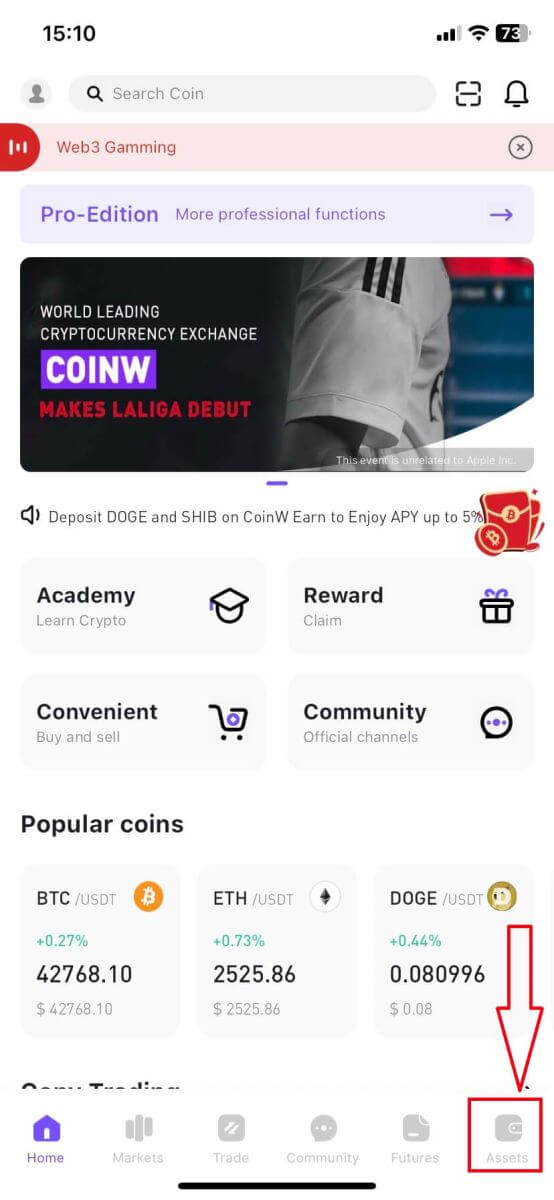

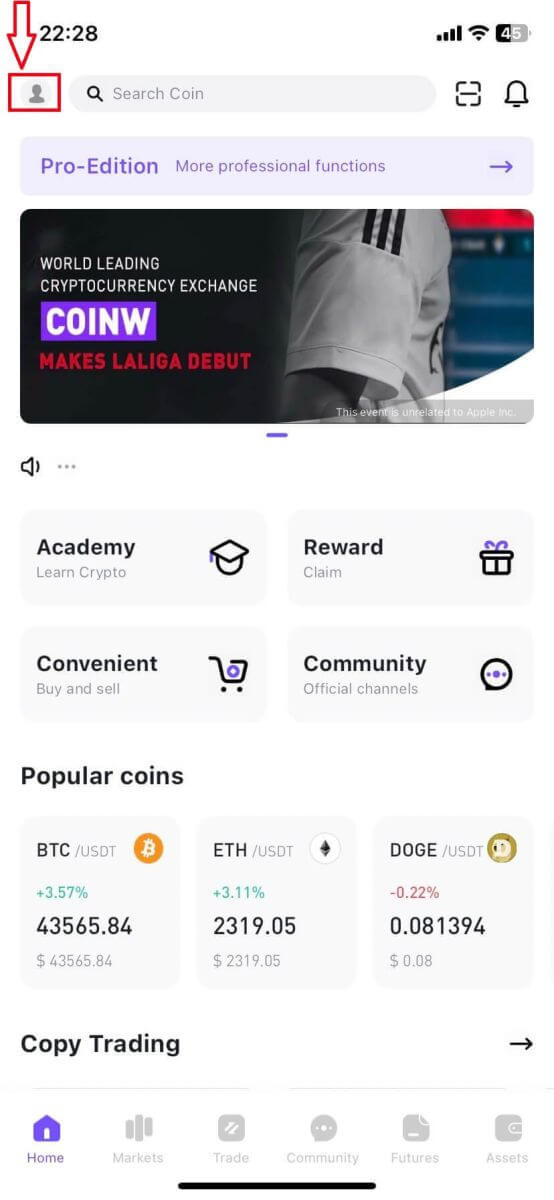

1. Open your CoinW app on your phone. Click on the [Assets].

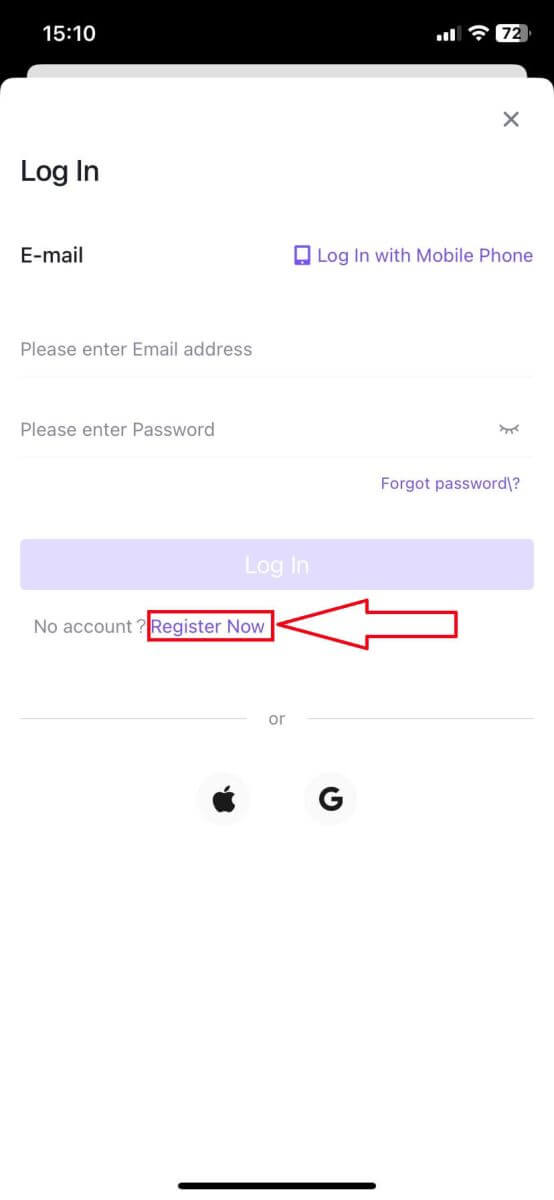

2. A pop-up log-in prompt will come up. Click on [Register Now].

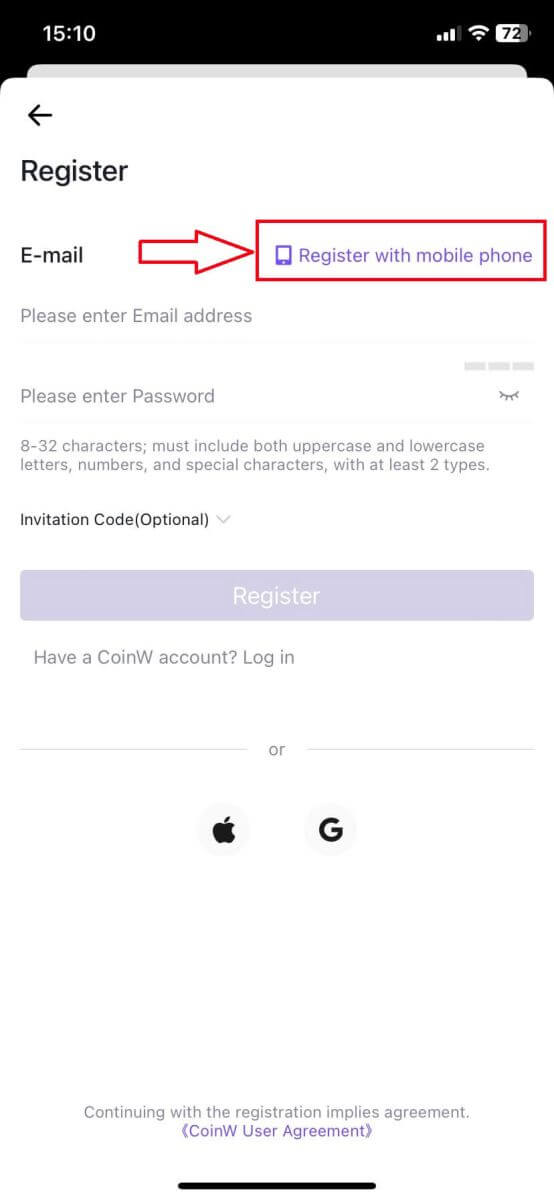

3. You could also switch the way to register by mobile phone/email by clicking on [Register with mobile phone]/[Register with email].

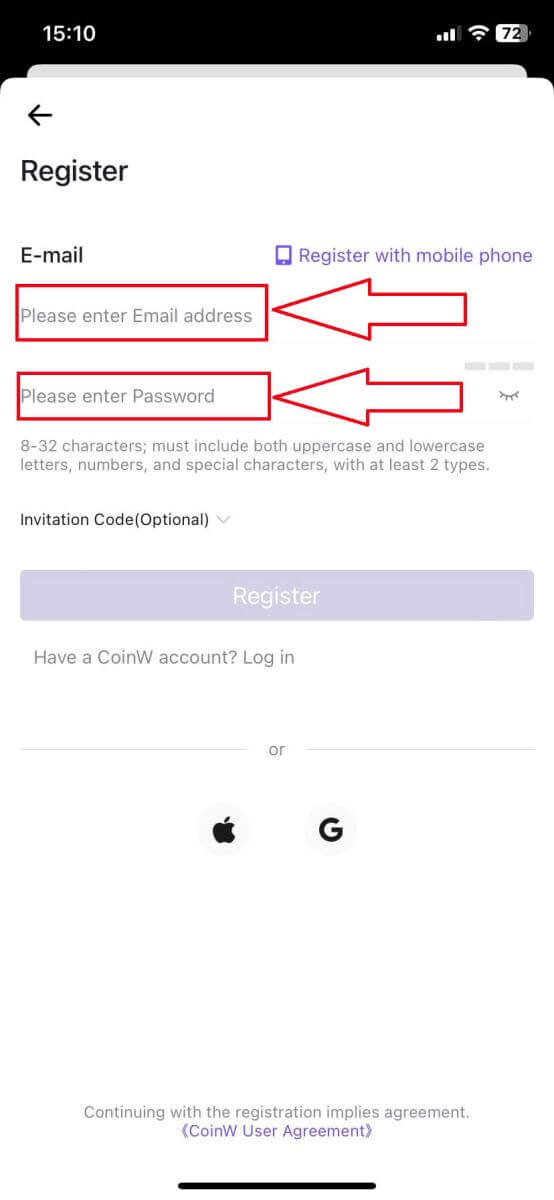

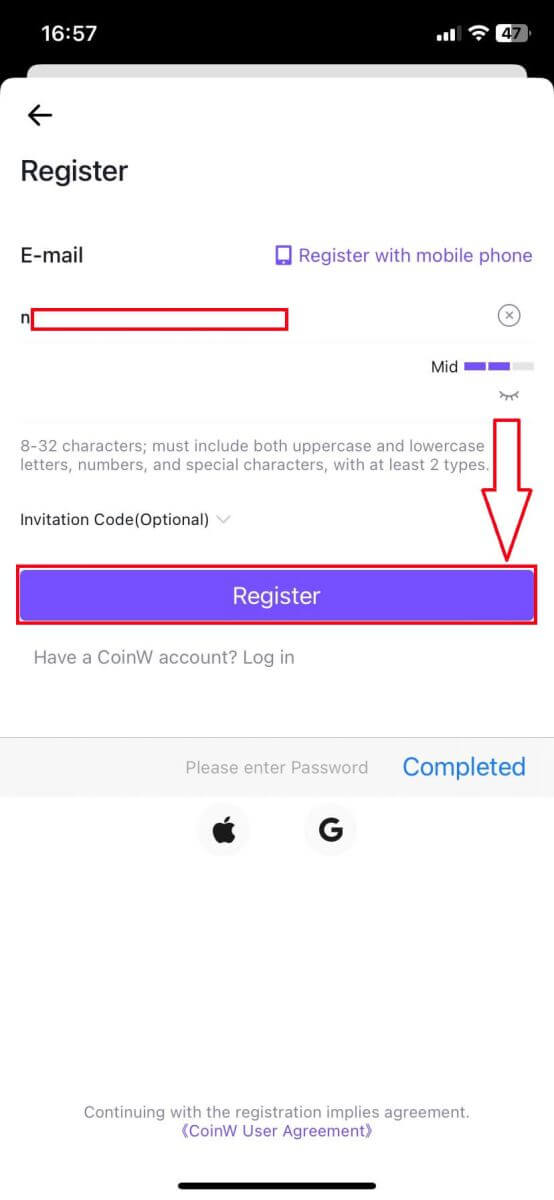

4. Fill out the phone number/email address and add the password for your account.

5. After that, click on [Register] to continue.

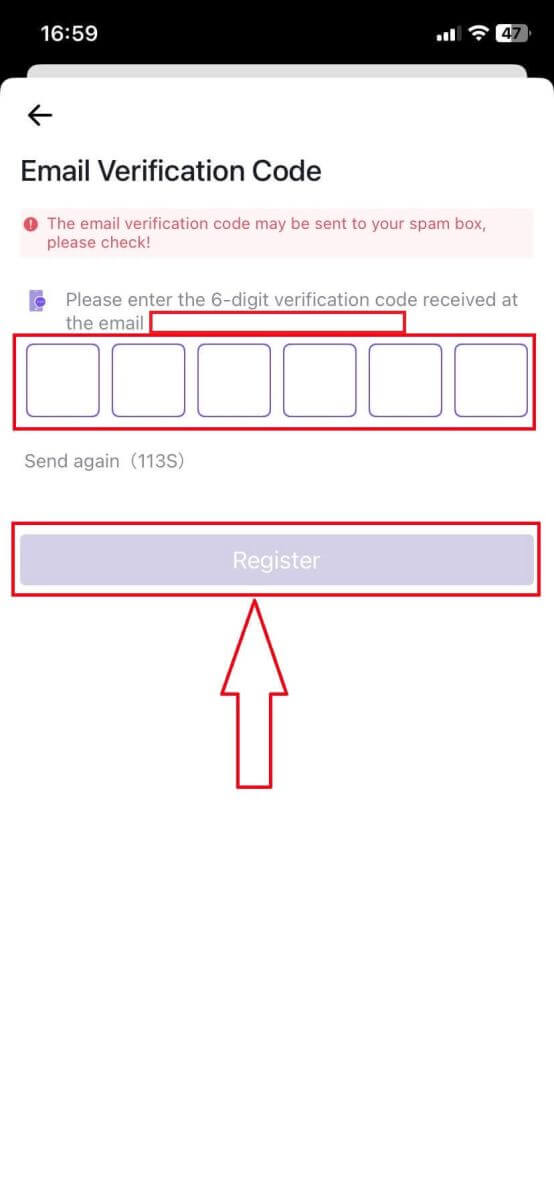

6. Type in the Email/SMS verification code to verify. Then click on [Register].

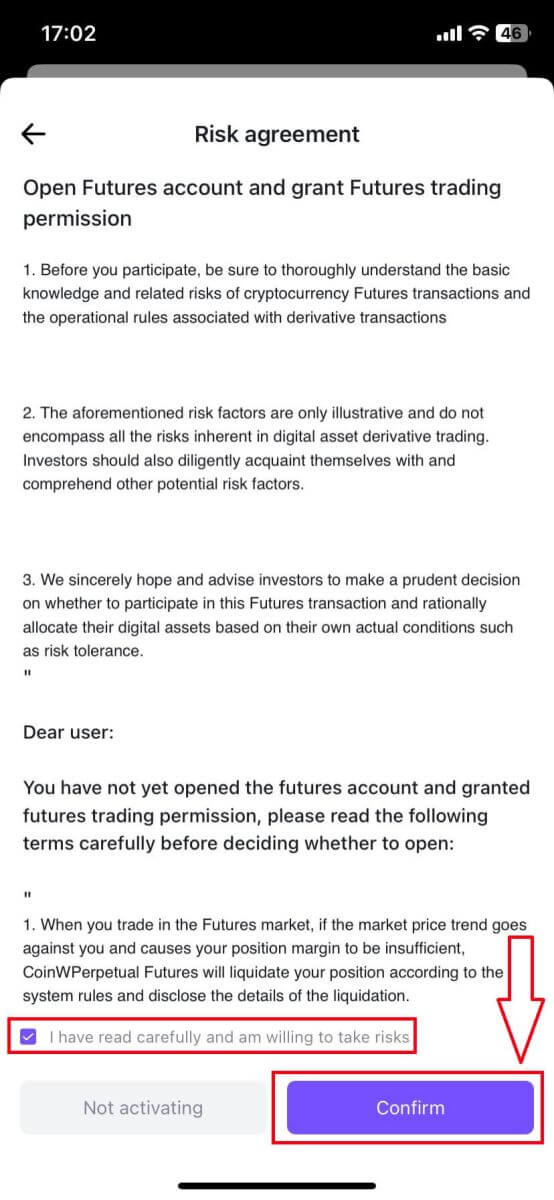

7. Tick the box to confirm the Risk agreement and click on [Confirm] to finish the process.

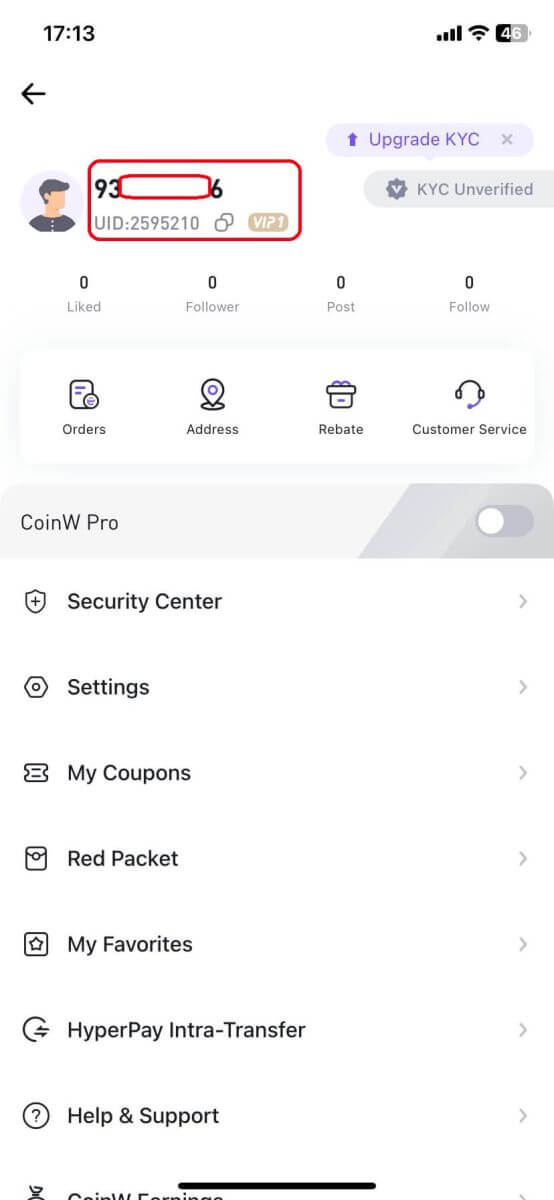

8. You can see your account ID by clicking on the account icon on the top left of the page.

Frequently Asked Questions (FAQ)

I can’t receive SMS or Email

SMS

First, check whether you have set SMS blocking. If not, please contact CoinW customer service personnel and provide your phone number, and we will contact the mobile operators.

First, check if there are emails from CoinW in your junk. If not, please contact CoinW customer service personnel.

Why can’t I open the CoinW site?

If you can’t open the CoinW site, please check your network settings first. If there is a system upgrade, please wait or login with CoinW APP.

Why can’t I open the CoinW APP?

Android

- Check if it is the latest version.

- Switch between 4G and WiFi and choose the best.

iOS

- Check if it is the latest version.

- Switch between 4G and WiFi and choose the best.

Account Suspension

To protect user assets and prevent accounts from being hacked, CoinW has set the triggers of risk control. When you trigger it, you will automatically be banned from withdrawing for 24 hours. Please wait patiently and your account will be unfrozen after 24 hours. The trigger conditions are as follows:

- Change phone number;

- Change login password;

- Retrieve password;

- Disable Google Authenticator;

- Change trade password;

- Disable SMS authentication.

How to Trade Crypto at CoinW

How to Trade Spot on CoinW (Web)

How to Transfer Assets on CoinW

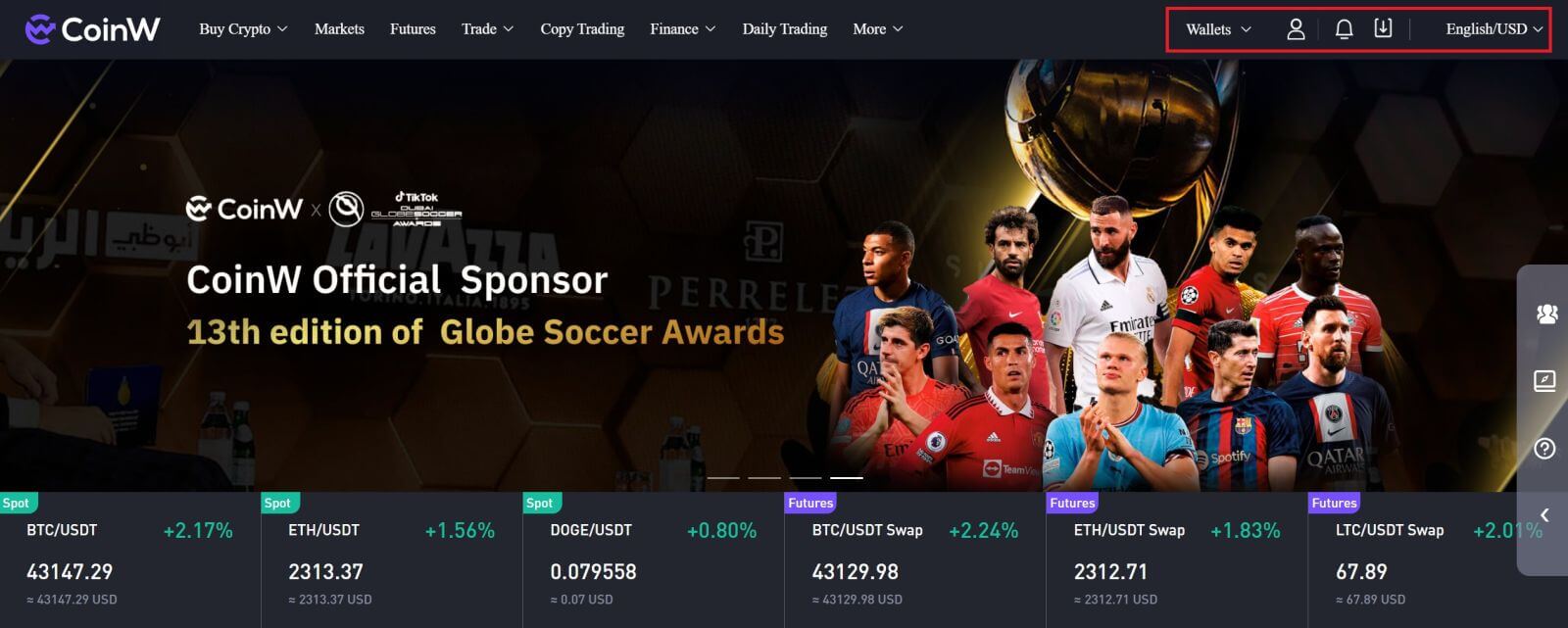

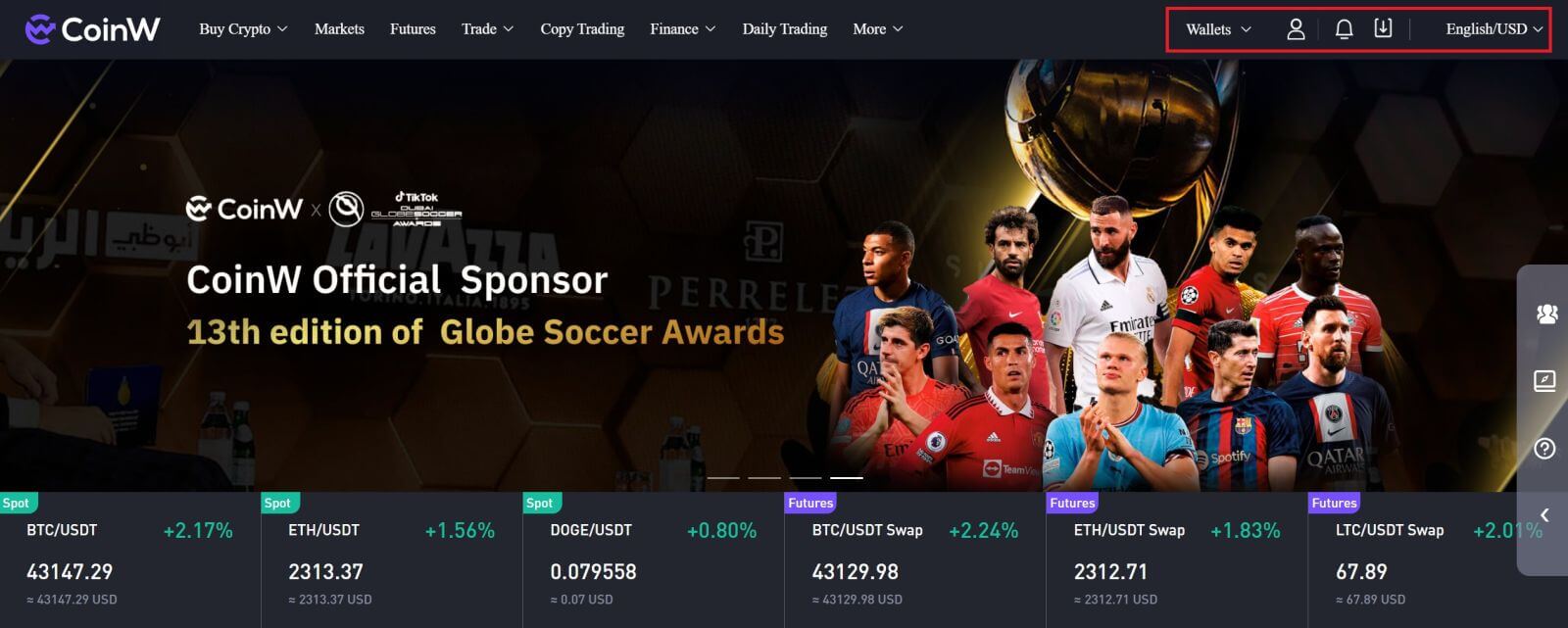

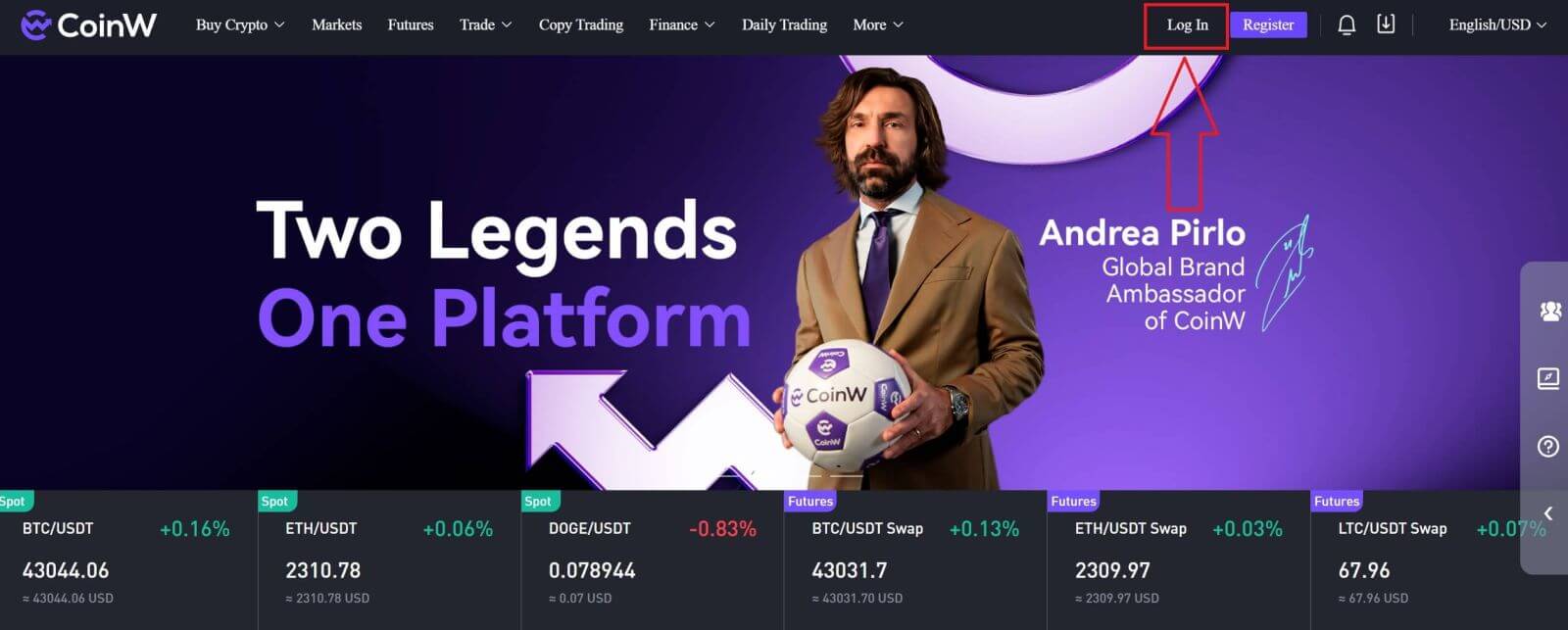

1. Visit the CoinW website, and click on [Log in] at the top right of the page to log into your CoinW account.

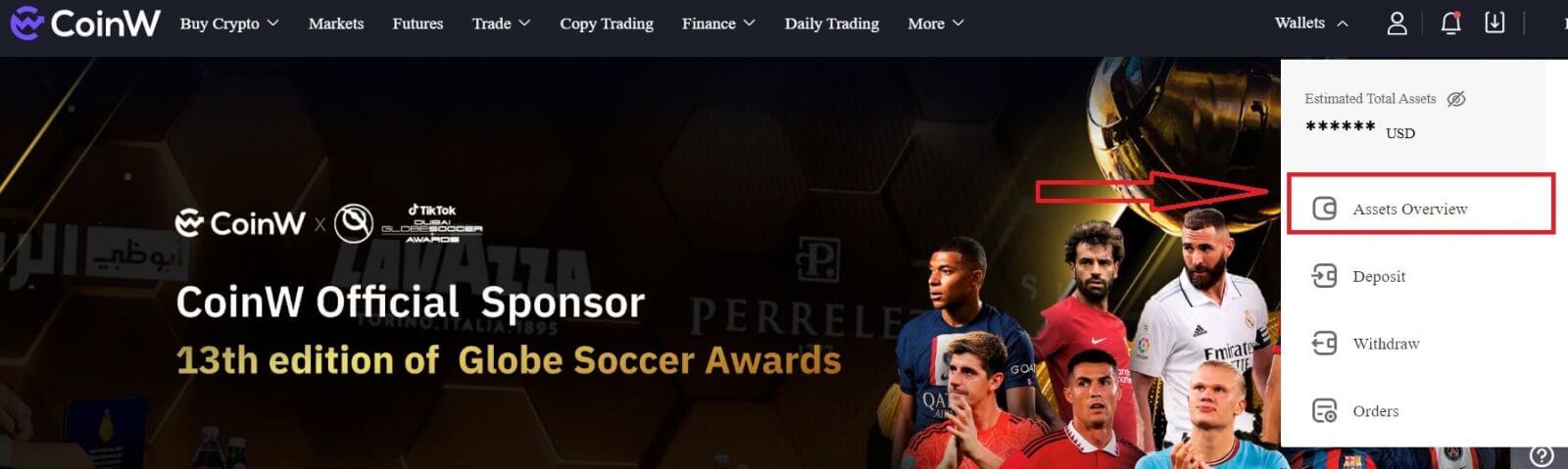

2. Click on [Wallets], and choose [Assets Overview].

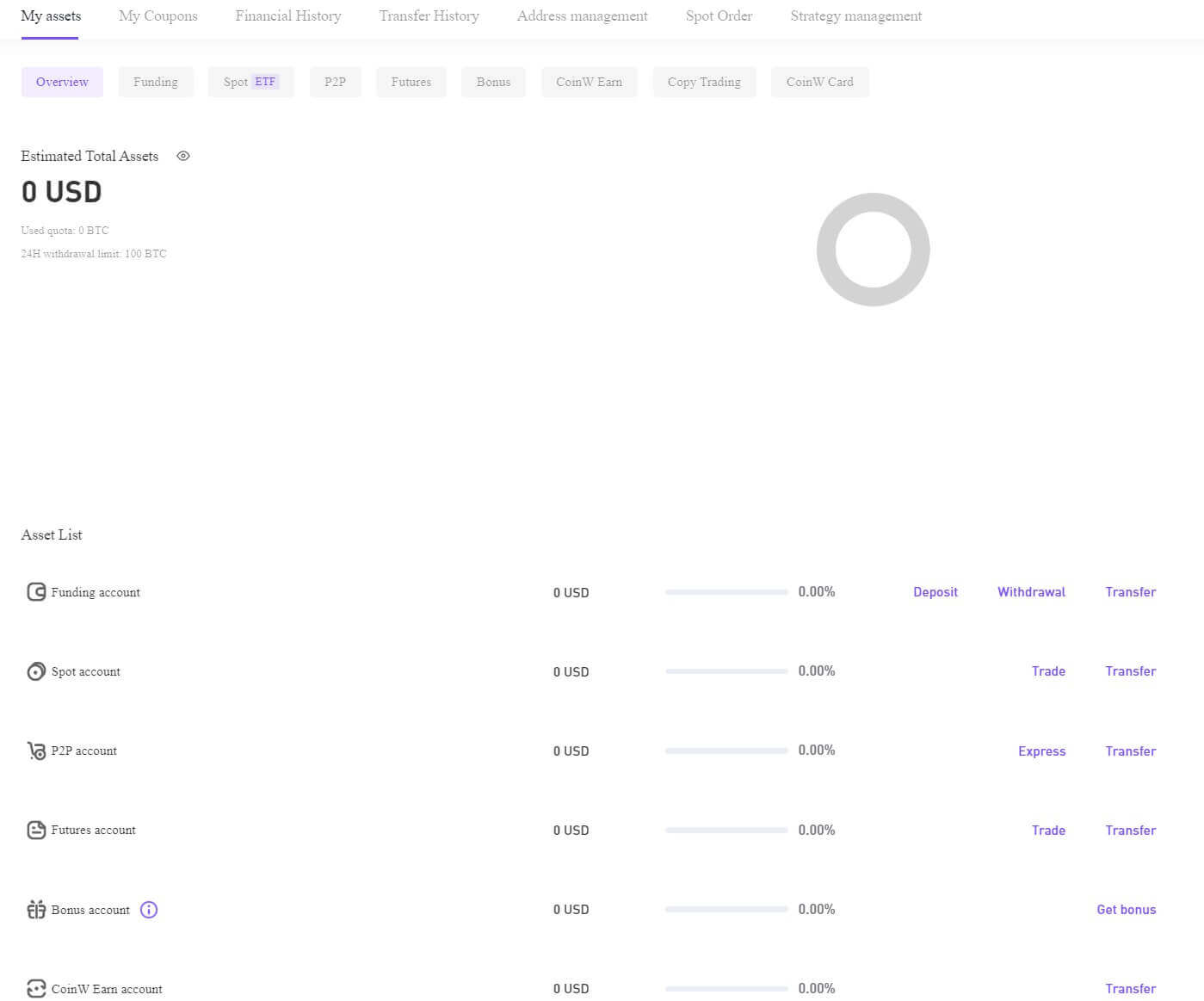

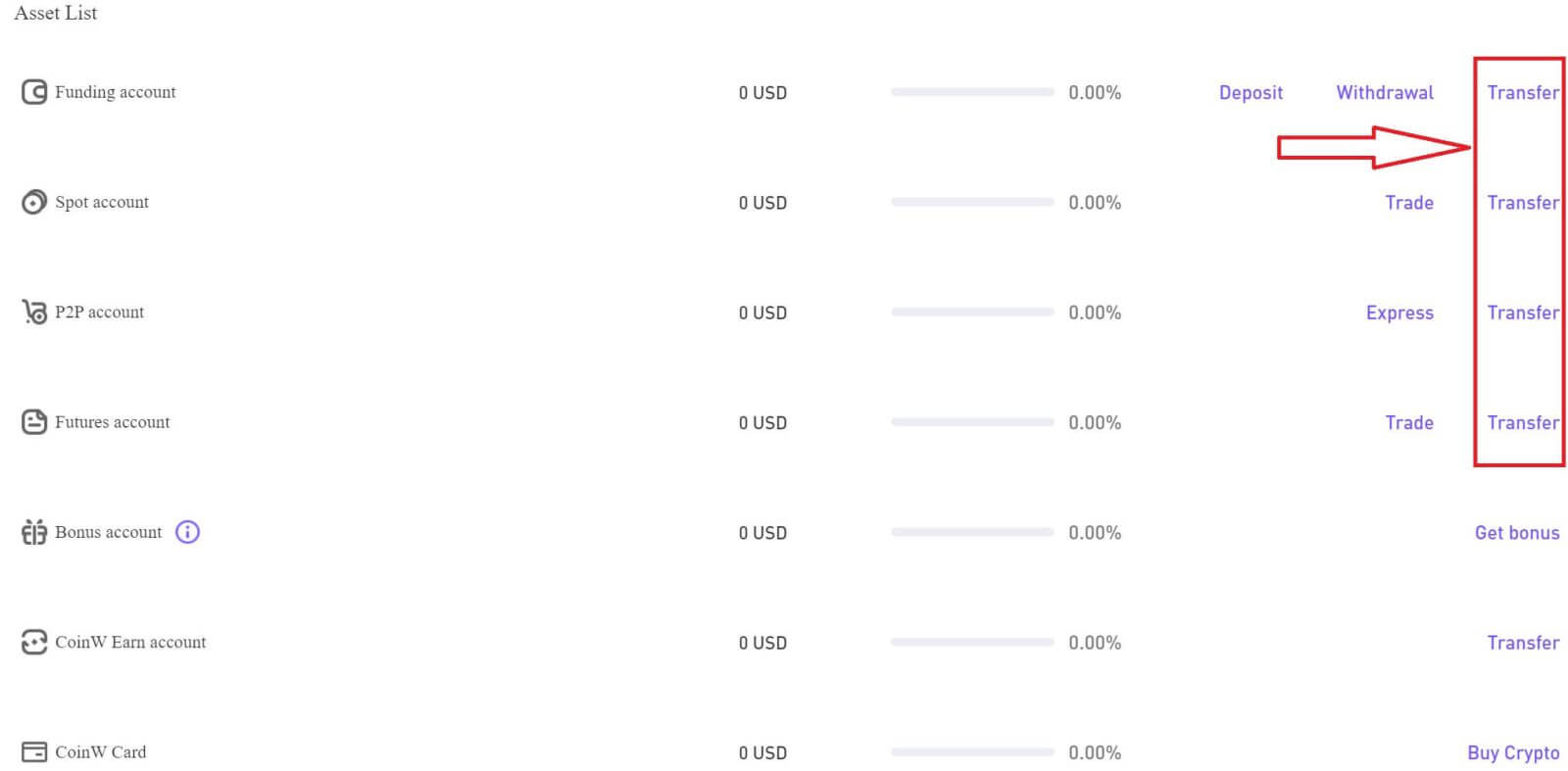

3. You will get into the main assets management.

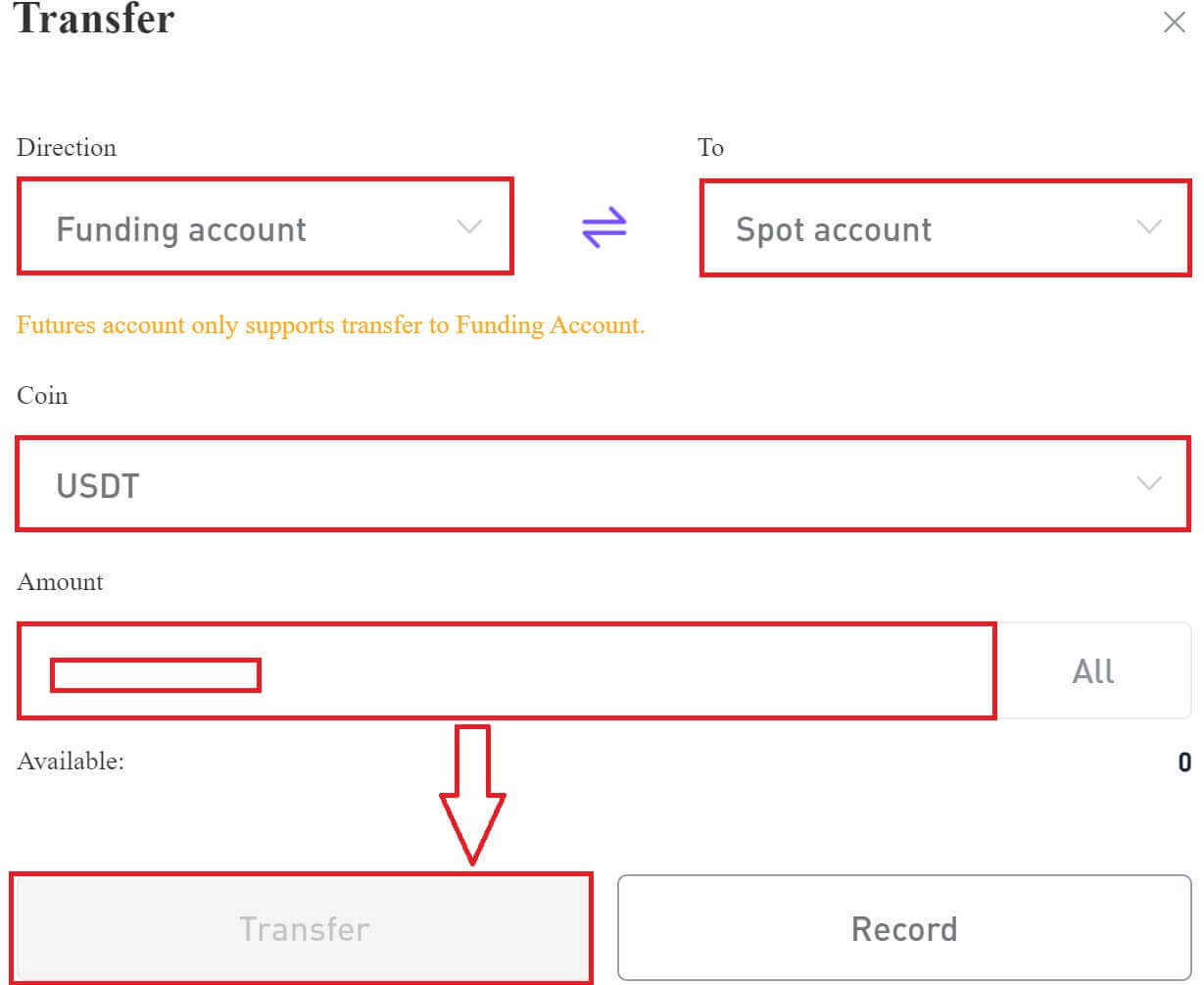

4. Next, select the type of account you want to make a transfer to and click on [Transfer] of that account row.

5. A pop-up Transfer window will come up, you need to choose the direction from where to and type of coin you want to make the transfer, also fill out the amount of this transfer, when you have done this, click on [Transfer] to proceed.

How to Buy/Sell Crypto on CoinW

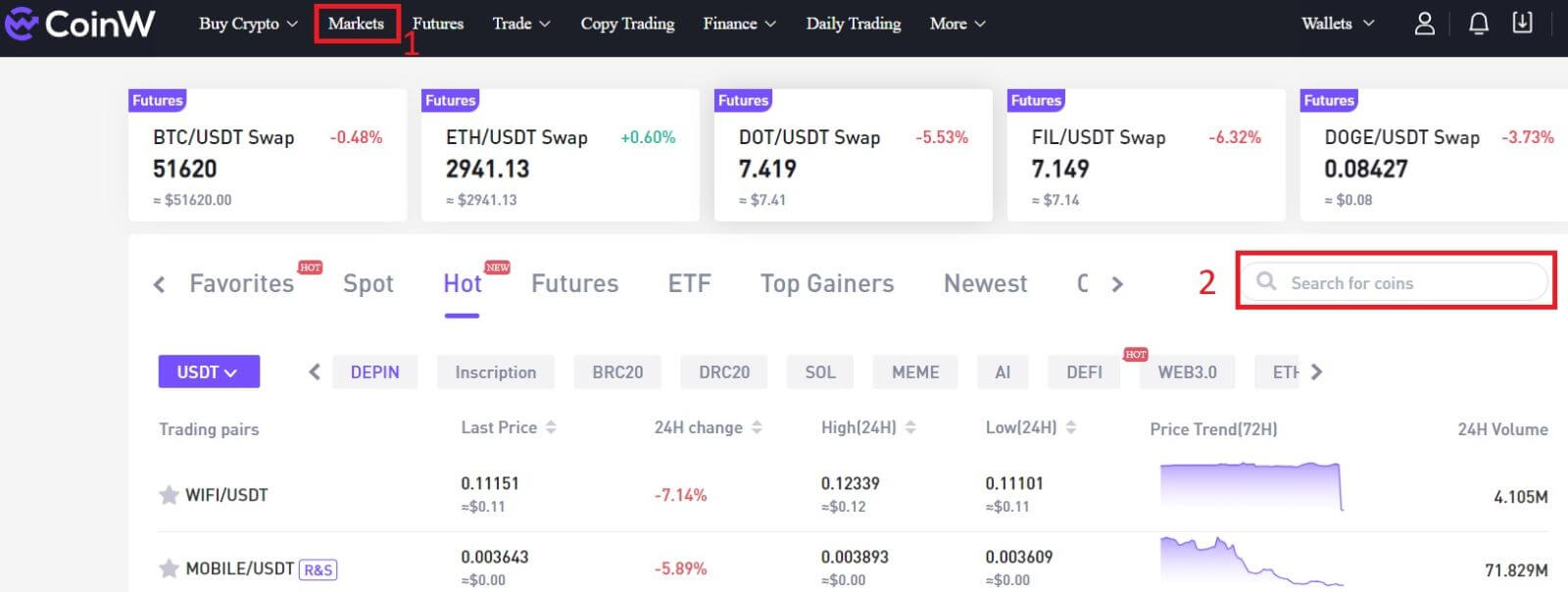

1. Use the [Market] section in the navigation bar to search for the desired trading pair.

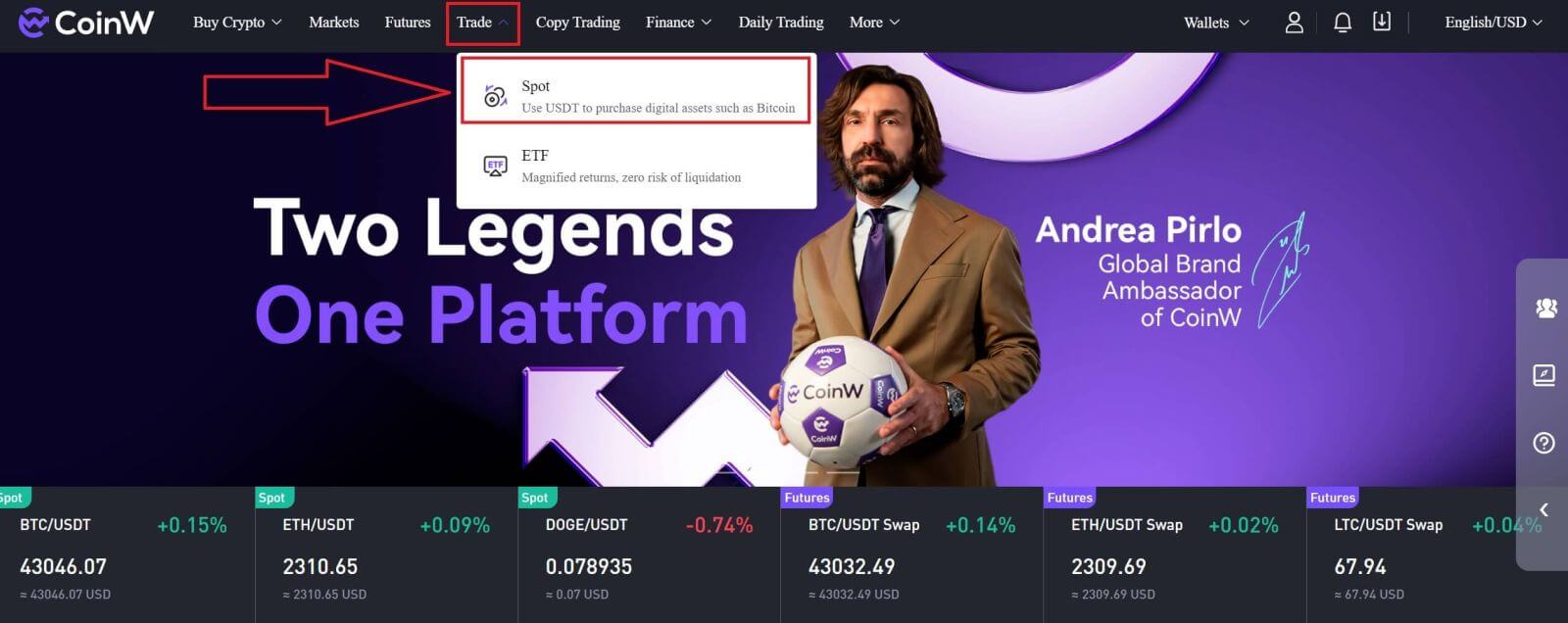

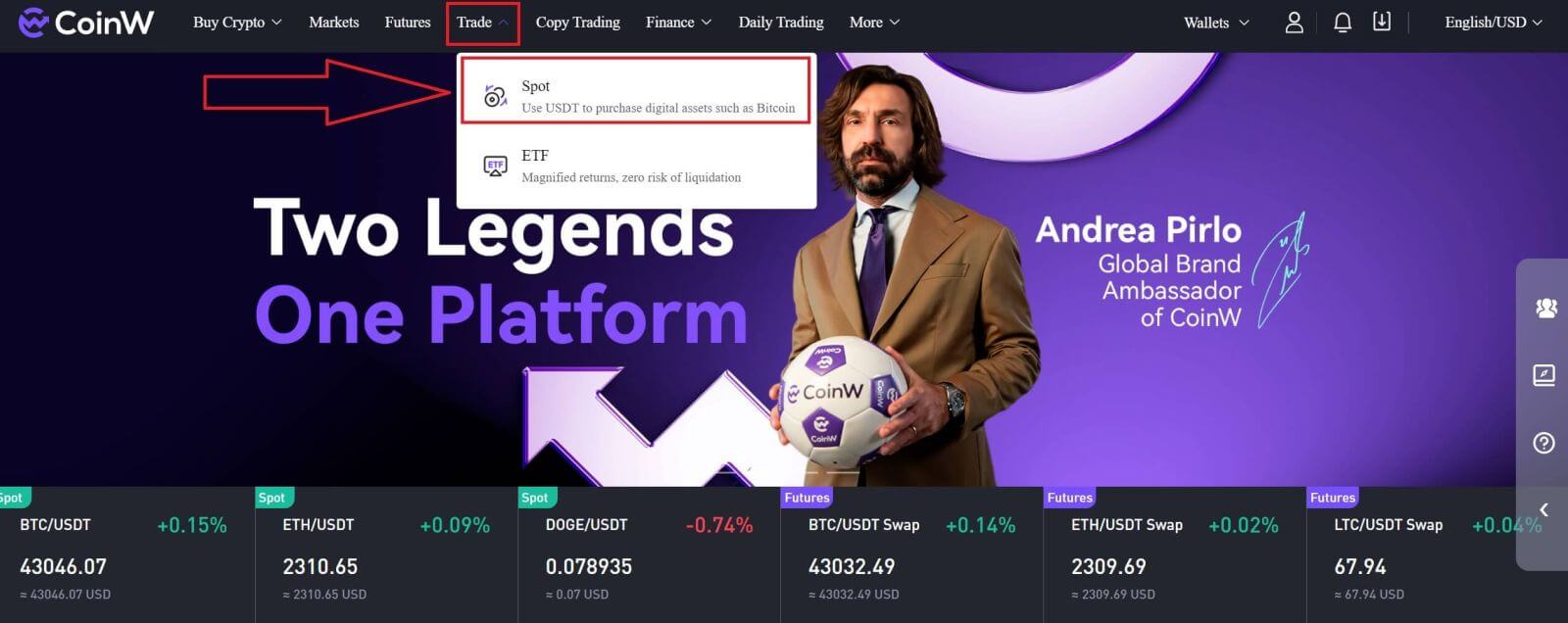

2. Alternatively, access the trading page by clicking on the [Trade], then choose [Spot]. The spot is using USDT to purchase digital assets like Bitcoin or ETH.

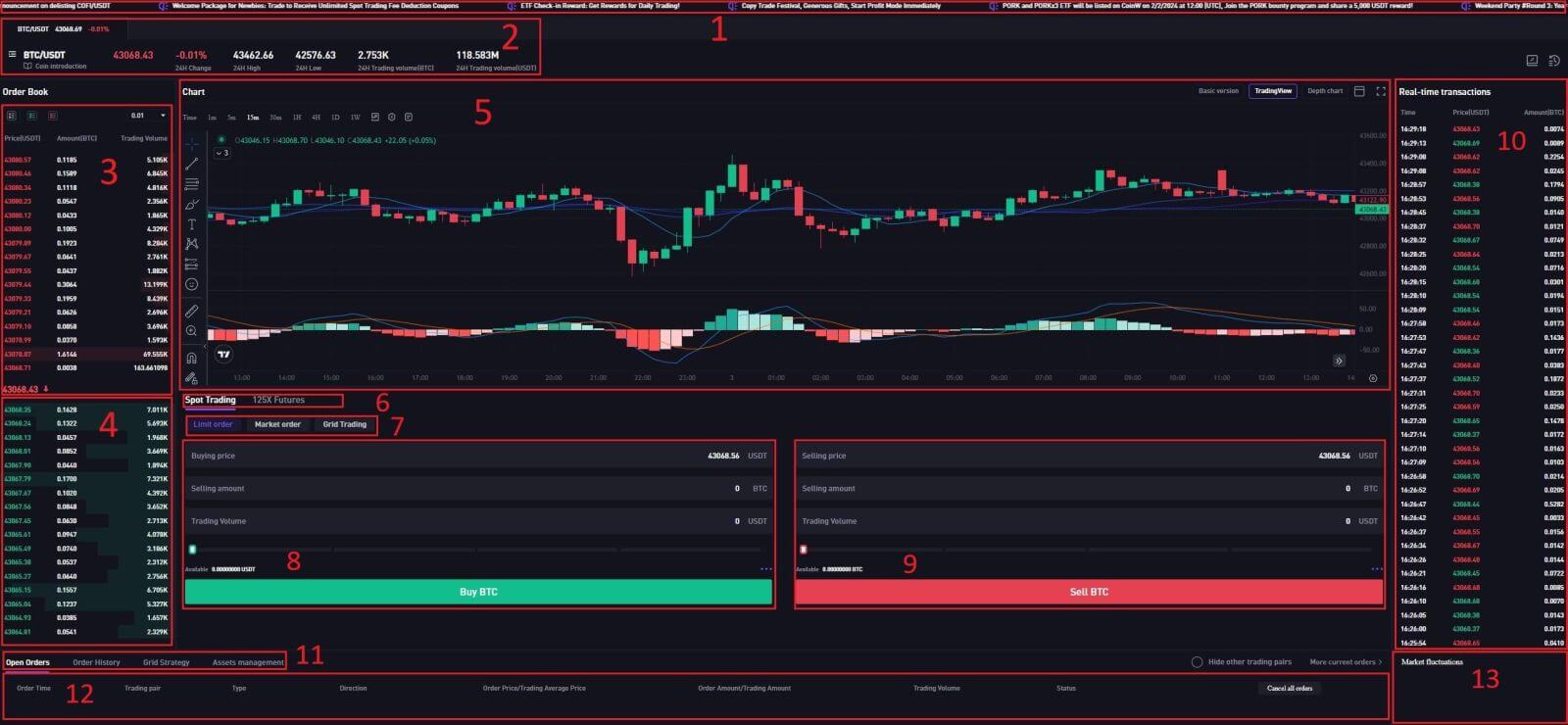

3. This is CoinW at the trading page interface.

- CoinW Announcements

- Trading volume of trading pair in 24 hours

- Sell order book

- Buy order book

- Candlestick Chart and Market Depth

- Trading Type: Spot/Cross Margin/Isolated Margin

- Type of order: Limit/Market/Grid Trading

- Buy Cryptocurrency

- Sell Cryptocurrency

- Market and Trading pairs.

- Open orders/Order History/Grid Strategy/ Assets management

- Information of each section in part 11

- Market Fluctuation

- Buying:

If you want to initiate a buy order, enter the [Buy] and [Amount] or [Total] one by one on the left side. Finally, click [Buy XXX] to execute the order.

- Selling:

If you want to initiate a sell order, enter the [Price], [Amount], and [Total] one by one on the right side. Finally, click [Sell XXX] to execute the order.

- Example:

Suppose User A wants to trade the BTC/USDT pair, intending to buy 1 BTC with 40,104.04 USDT. They input 40,104.04 in the [Buy Price] field, and 1 in the [Amount] field, and the transaction amount is automatically calculated. Clicking [Buy] completes the transaction. When BTC reaches the set price of 40,104.04 USDT, the buy order will be executed. 5. You can follow the same steps to sell BTC. Make sure to fill out the price you want carefully.

5. You can follow the same steps to sell BTC. Make sure to fill out the price you want carefully.

6. CoinW has 2 Order Types:

- Limit Order:

Set your own buying or selling price. The trade will only be executed when the market price reaches the set price. If the market price does not reach the set price, the limit order will continue to wait for execution.

- Market Order:

This order type will automatically execute the trade at the current best price available in the market.

How to Trade Spot on CoinW (App)

How to Transfer Assets on CoinW

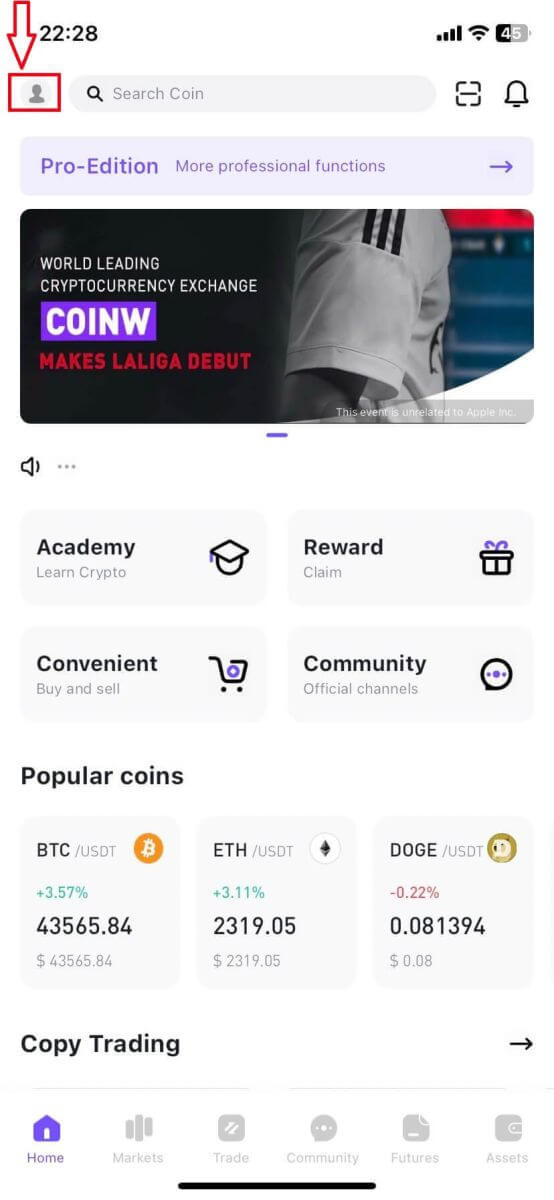

1. Log in to the CoinW app, and click on the profile icon on the top left corner.

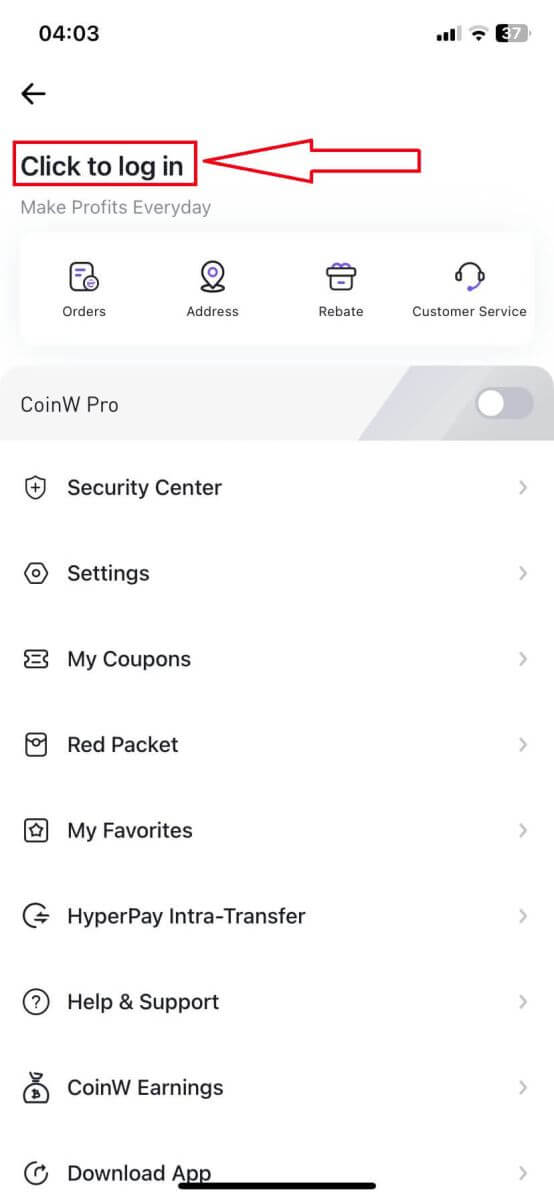

2. Click [Click to log in] to log in to your account.

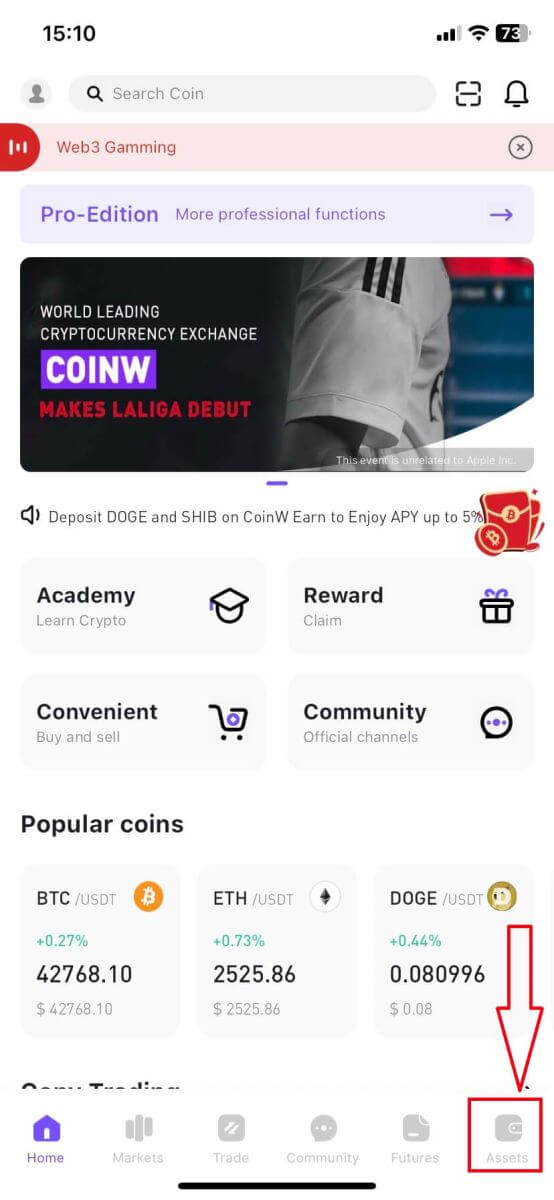

3. Click on [Assets] in the below right corner.

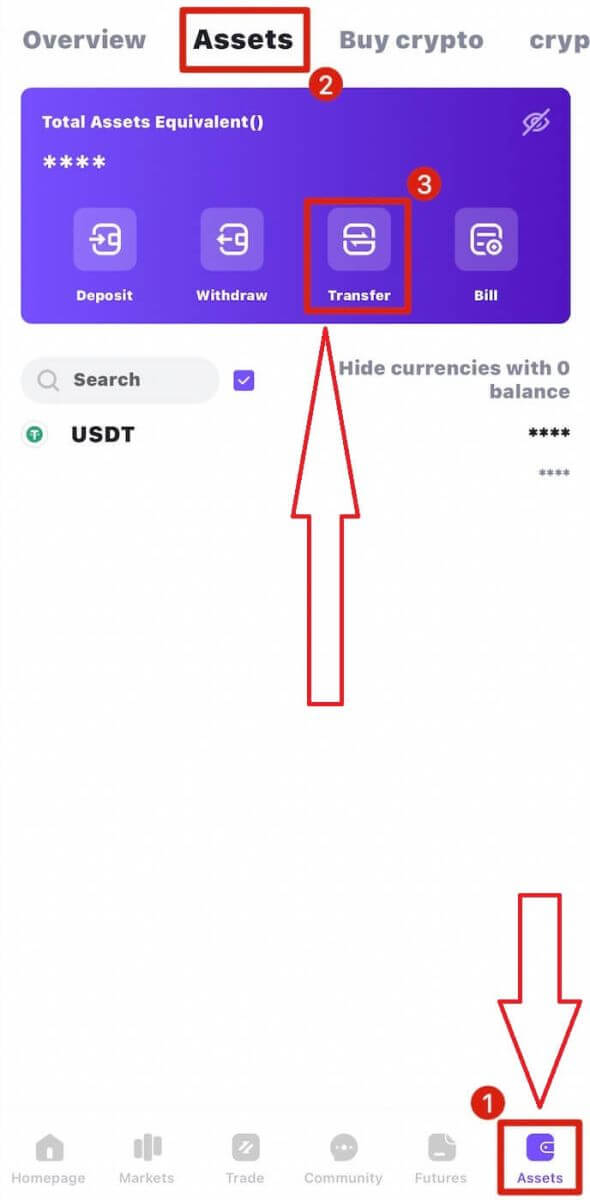

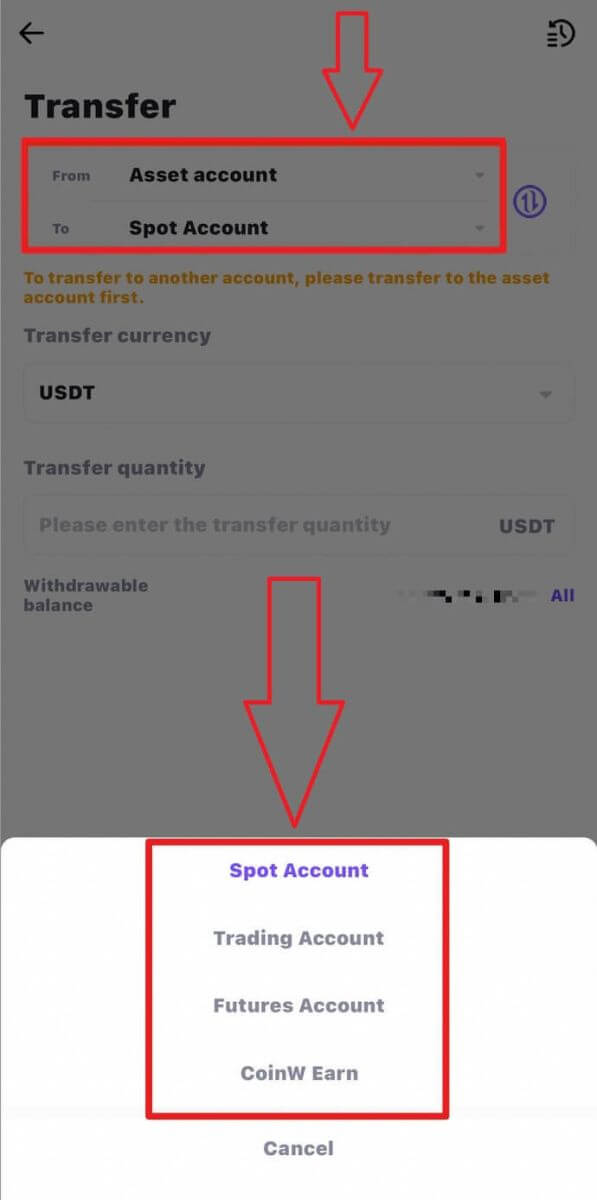

4. In the navigation bar, click on [Assets], then select [Transfer].

5. Choose the account you wish to transfer. If you intend to engage in spot trading, transfer your assets to the [Spot Account].

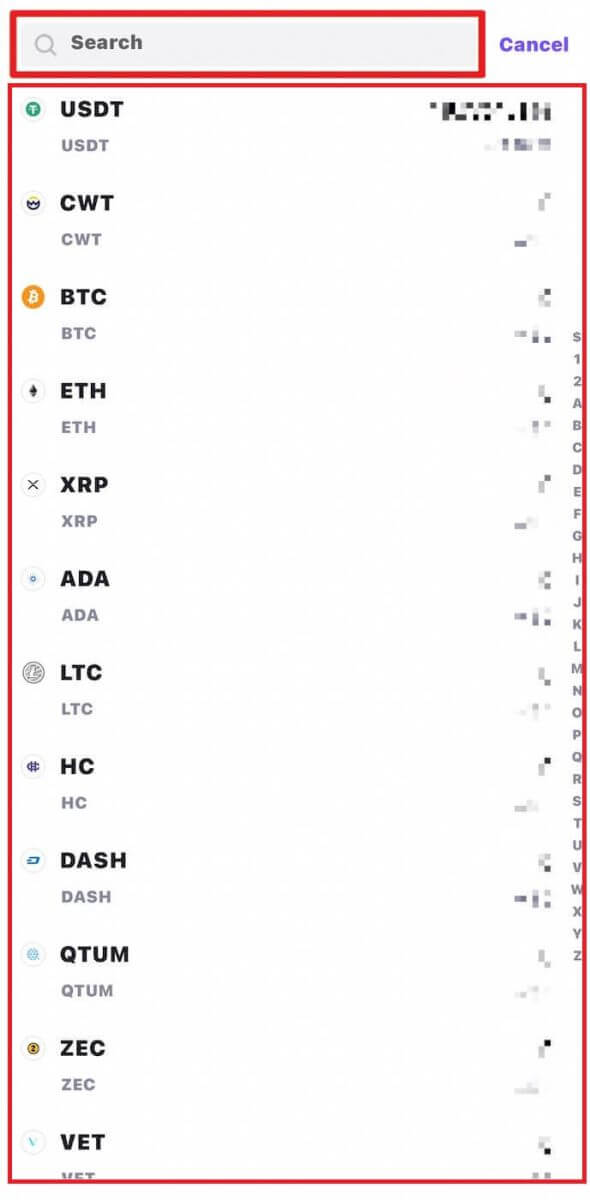

6. Choose the currency you want to trade or directly search for it in the search box.

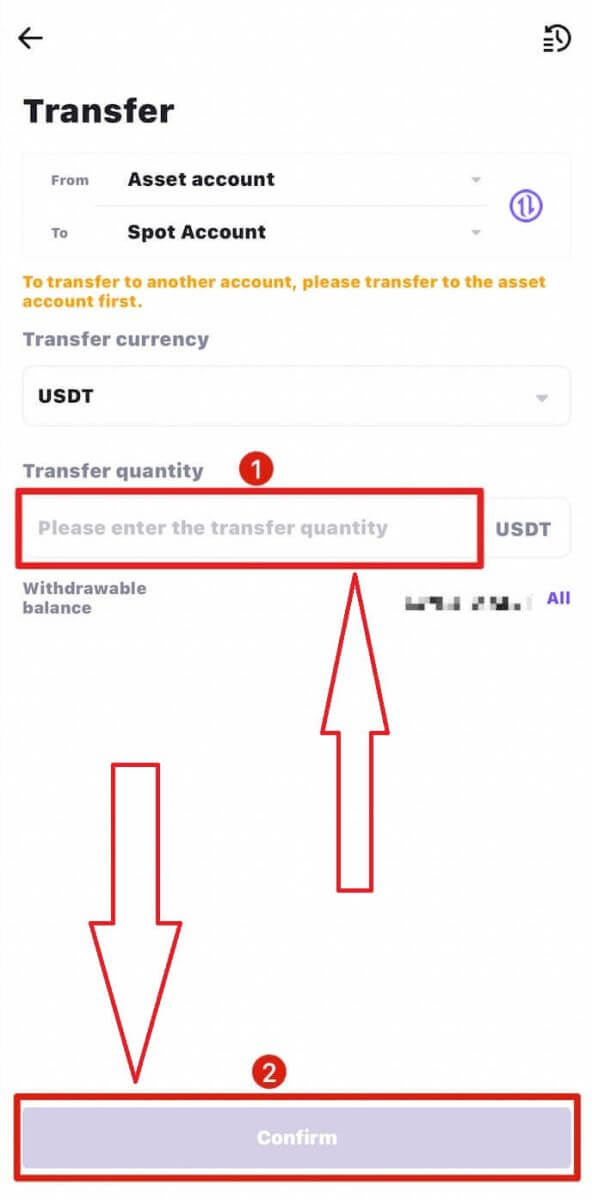

7. Enter the transfer amount and click [Confirm] to proceed.

How to Buy/Sell Crypto on CoinW

1. In the bottom navigation bar, click [Market - Spot] to search for the desired trading pair. Alternatively, click [Trade] in the bottom navigation bar to enter the spot trading page. Use the left-side currency column to search for the desired trading pair and click to enter the trading interface.

(Note: To engage in spot trading, you must transfer your assets to the [Spot Account] before trading. For information on account transfers, please refer to the above section.)

2. Choose the trading type: [Buy] or [Sell] and the order type: [Limit Order] or [Market Order].

- Buying:

If you want to initiate a buy order, enter the [Price], [Amount], or [Total] on the left side. Finally, click [Buy] to execute the order.

- Selling:

If you want to initiate a sell order, enter the [Price], [Amount], or [Total] on the right side. Finally, click [Sell] to execute the order.

- Example:

Suppose User A wants to trade the CWT/USDT pair, intending to buy an amount of 100 CWT with the price is 0.11800 USDT for 1 CWT. They input 0.11800 in the [Price] field, and 100 in the [Amount] field, and the transaction amount is automatically calculated. Clicking [Buy CWT] completes the transaction. When CWT reaches the set price of 0.11800 USDT, the buy order will be executed.

Same as that, suppose user A wants to trade the CWT/USDT pair, intending to sell an amount of 100 CWT with the price is 0.11953 USDT for 1 CWT. They input 0.11953 in the [Price] field, and 100 in the [Amount] field, and the transaction amount is automatically calculated. Clicking [Sell CWT] completes the transaction. When CWT reaches the set price of 0.11953 USDT, the sell order will be executed.

4. CoinW has 2 Order Types::

- Limit Order:

Set your own buying or selling price. The trade will only be executed when the market price reaches the set price. If the market price does not reach the set price, the limit order will continue to wait for execution.

- Market Order:

This order type will automatically execute the trade at the current best price available in the market.

What is the Grid-Trading Function

What is a Grid-Trading order?

- Definition

Grid trading is a type of quantitative trading strategy. This trading bot automates buying and selling on spot trading. It is designed to place orders in the market at preset intervals within a configured price range.

Grid trading is when orders are placed above and below a set price, creating a grid of orders at incrementally increasing and decreasing prices. In this way, it constructs a trading grid.

- Fees

The fee rate of the spot order executed by the spot strategy bot. Maker Takers are both 0.1%.

- Create Schema

There are two ways to create a grid strategy. One is to create it manually: set the grid parameters according to your own judgment on the volatile market; the other is to generate a grid with one click through the AI intelligent algorithm. The AI intelligent algorithm will combine the recent market and The backtest data to give dynamic grid strategy parameters.

- Lowest Price

The grid strategy will not execute orders below the lowest price of the grid.

When the trigger price is set, it cannot exceed 400% of the trigger price; when the trigger price is not set, it cannot exceed 400% of the current price.

- Highest Price

The grid strategy will not execute orders above the highest price of the grid.

- Grid Type

Arithmetic mode (The difference between the prices of every two adjacent orders is equal, the price difference = (highest price - lowest price) / grid quantity, such as 100/140/180/220 USDT)

Geometric mode(The ratio of the prices of every two adjacent tiers of pending orders is equal, price ratio = (highest price / lowest price) ^ (1/grid number) , such as 10/20/40/80 USDT)

- Number of Grids

The number of adjacent pending orders ranges between the grid high and low.

The precision is 0, limited to [2,200], and the net rate of return per grid cannot be less than or equal to 0.

For example, the parameters with the highest price of 100U, the lowest price of 1600U, a proportional grid, and a grid of 4 are correspondingly divided into 4 grids of 100-200, 200-400, 400-800, and 800-1600.

-

Investment Amount

The amount of funds the user expects to invest in the grid strategy, the investment amount of grid trading will be isolated from the spot account as an independent position, and the order will be placed according to the established strategy. The actual amount of funds used to create the grid depends on market conditions and may not equal the amount entered by the user.

- Trigger Price

After the trigger price is set, the grid strategy will not start running immediately after the strategy is successfully created. The grid will only start running when the latest transaction price of the benchmark currency crosses the strategy trigger price. Users, please make sure that when the grid strategy is triggered, the spot account has enough investment funds available.

For example, when the strategy is created, the transaction price is 2333, and the strategy trigger price is set to 2000, then the strategy will start to run when the latest transaction price is less than or equal to 2000; similarly, when the strategy trigger price is set to 3000, then when the latest transaction price The strategy will only start running when it is greater than or equal to 3000.

- Take Profit Price

When the latest transaction price of the benchmark currency rises to this price, the strategy is automatically terminated and all benchmark currencies in the current strategy are sold at the market price.

The take profit price is greater than the highest price, and cannot be less than the current price. When the trigger price is set when the grid is initially created, the take profit price cannot be less than the trigger price.

- Stop Loss Price

When the latest transaction price of the benchmark currency falls to this price, the strategy will automatically terminate and all benchmark currencies in the current strategy will be sold at the market price.

The stop loss price is less than the minimum price, and cannot be greater than the current price. When the trigger price is set when the grid is initially created, the take-profit price cannot exceed the trigger price.

-

Follow Settings

Whether to allow others to view the benefits of this strategy and follow them according to this strategy. The follower position will be liquidated when it is terminated, and the total profit of the position will be deducted according to the set ratio and transferred to the account of the strategy sponsor.

- Strategy Run

By way of example, the strategy operation rules are simulated, and the grid parameters are as follows:

Trading pair: BTC/USDT

Price when creating the strategy: 29600 USDT

Lowest price: 21000 USDT

Highest price: 43000 USDT

Grid Type: Uniform

Number of grids: 22

Investment amount: 3300U

Strategy trigger price: 32500 USDT

Take Profit Price: 56000 USDT

Stop Loss Price: 18000 USDT

Follow Settings: Do not allow others to follow

- The first stage: the policy is successfully created, and the state is to be triggered.

The strategy will not be triggered until the price of BTC/USDT reaches 32500 USDT. Strategies with no trigger price set skip phase one.

- The second stage: The strategy is triggered, and a pending order is initially opened.

When the price of BTC/USDT reaches (or exceeds) 32,500 USDT, the strategy is triggered, and the system will lock the expected investment amount in the currency account. The system will calculate the prices of all pending orders in the grid (21000/22000/23000…40000/41000/42000 respectively) according to the strategy parameters, and then place a buy order at these prices. If the market depth is good, the price will be at 32500 All the above buy orders will be filled, and the grid strategy will place sell orders at one level higher than the price of the traded buy orders. At this time, 34000/35000/36000/37000/38000/39000/40000/41000/42000/43000 prices are all pending sell orders, 21000/22000/23000/24000/25000/26000/27000/28000/31000/20000 All prices are pending buy orders.

After completing the position opening operation, the remaining unfrozen investment funds in the strategy (not used by the strategy order) will be unlocked, and the expected investment amount - the unlocked part will be equal to the actual investment amount.

- The third stage: strategy operation, position covering,g and arbitrage.

If the price of BTC/USDT falls below 32000, the buy order will be filled at this position (Buy at a low price), and the program will automatically place a sell order at the position of 33000 (the small grid of 32000-33000 corresponds to the upper position), and the number of sell orders is a single grid buy volume. If the price of BTC/USDT rises above 33000, the sell order will be filled ( Sell at a high price), and the program will automatically place a buy order at the position of 32000 (the small grid of 32000-33000 corresponds to the lower position), and the number of buy orders is a single grid buy volume. Only after the pending order at the current level is completely filled, the system will place an order in the opposite direction at the corresponding position. When the price of BTC/USDT does not break through the highest price and lowest price of the strategy, by placing orders and transactions cyclically with market fluctuations, you can continue to earn volatile returns in the volatile market. If the price of BTC/USDT continues to fall below 21,000, the system will no longer carry out buy-to-cover operations. Similarly, after the price continues to rise above 43,000, the system will no longer carry out sell arbitrage operations.

The price currency income generated by arbitrage cannot be used until the strategy is terminated, it is locked in the strategy position, and it is only used to pay the pending order fee.

- The fourth stage: Policy Termination.

If the price of BTC/USDT falls below 18000, the strategy will start to stop loss and terminate. At this time, after the system cancels the pending order information of the strategic position, it will sell all the benchmark coins held in the strategic position at the market price, after that, all the price coins in the position will be unlocked. The price coin is unlocked. In the same way, if the price of BTC/USDT exceeds 56000, the strategy will start the take profit termination. At this time, after the system cancels the pending order information of the strategy position, it will sell all the remaining benchmark coins in the strategy position at the market price. After that, all the price coins in the position will be unlocked.

There is also a situation where the user manually terminates the strategy. At this time, if the user chooses to sell all the benchmark coins and then terminate the strategy, the system will withdraw the pending order information of the strategy position and sell all the benchmark coins held in the strategy position at the market price. Unlock all the price coins in the position; if the user does not choose to sell all the base coins and then terminate the strategy, the system will unlock all the price coins and base coins in the position after withdrawing the pending order information of the strategic position.

In the case of a follow-up strategy in which the total revenue is profit, the system will transfer part of the revenue with the total revenue as profit to the currency account of the strategy sponsor

- Actual Investment

The actual investment amount, the amount of assets actually used after the grid strategy position is created, and the unit of price currency.

- Total Revenue

The total revenue since the grid strategy runs, and the revenue is converted into price currency units. Total Return = Grid Profit + Floating PL

Yield = Total Return / Actual Investment Amount * 100%

- Annualized Rate of Return

Annualized rate of return = total return / actual investment amount * 365 * 24 * 60 * 60 / number of seconds the strategy has been running * 100%

- Floating Profit And Loss

The fluctuation in value is caused by the rise and fall of the base currency of the current trading pair. It is the change of the latest price of the benchmark currency for the current trading pair relative to the average buying price.

Total floating profit and loss = sell order floating profit and loss + buy order floating profit and loss

Sell order floating profit and loss = remaining trading currency quantity * latest price + invoicing currency quantity obtained from the selling part - invoicing currency quantity consumed by the matching buy order

Buy order floating profit and loss = transaction quantity * (last price - average transaction price)

When the grid strategy is running, the price of the currency pair is the latest price of the base currency; when the grid strategy is terminated, the price of the currency pair is the price of the benchmark currency when the grid is terminated.

Floating profit and loss ratio = floating profit and loss / actual investment amount * 100%

- Grid Profit

The realized profit generated by grid trading is the sum of the profits generated by the traded sell orders paired with the buy orders.

Grid Profit = Paired Profit

The buy orders in the grid strategy are commissioned one by one from the lowest price upwards. The traded buy orders are in a stack structure. After arbitrage, each traded sell order is matched with a traded buy order at the top of the stack, and then the matching profit is calculated.

Matching Profit = Sell Order Volume - Buy Order Volume

Buy order turnover = transaction quantity * transaction price + buy order handling fee

Sell order turnover = trade quantity * trade price - sell order handling fee

Grid Profit Rate = Grid Profit / Actual Investment Amount * 100%

- Net Yield of Per Grid

Net yield per grid refers to the profit percentage after matching buy and sell orders for each grid. After the equal difference/proportion mode is determined, the net rate of return per grid can be calculated from the highest price, the lowest price, the number of grids, and the grid transaction fee. Net yield per grid must be greater than 0.

For the Arithmetic mode, the net rate of return per grid is an interval, the minimum net rate of return per grid is generated by the topmost grid, and the maximum net rate of return per grid is generated by the bottom grid.

- Single Grid Buy Volume

Single grid buying volume refers to the buying volume of pending orders for each grid at different price levels during the grid operation.

How to create a Grid-Trading order in CoinW

1. First, go to [Trade], and choose [Spot].

2. Choose [Grid Trading]. If you are a newbie to Grid Trading, you could choose [Follow more grid strategies] to follow others’ strategies and copy theirs for your first Grid Trading.

3. Looking for the strategy you want then click on [Follow the Strategy] to choose it.

4. Select the amount of investment that you want, then click on [Create the following grid].

5. Or if you want to set it manually, you could do it also, filling out all of the trading information.

6. Choose the net rate of yield per grid then click on [Create grids manually].

Frequently Asked Questions (FAQ)

What is a Limit Order

A limit order involves specifying a particular price and placing it on the order book. It differs from a market order in that it does not execute instantly. Instead, the limit order will only be completed when the market price reaches or surpasses your specified limit price. This allows you to potentially buy at a lower price or sell at a higher price compared to the prevailing market price.

For instance, imagine setting a buy limit order for 1 BTC at $60,000, while the current BTC price is $50,000. In this scenario, your limit order will be immediately filled at the better price of $50,000, as it is below your specified limit of $60,000.

Likewise, if you set a sell limit order for 1 BTC at $40,000 and the current BTC price is $50,000, the order will promptly be executed at $50,000 because it represents a superior price compared to your specified limit of $40,000.

| Market Order | Limit Order |

| Purchases an asset at the market price | Purchases an asset at a set price or better |

| Fills immediately | Fills only at the limit order’s price or better |

| Manual | Can be set in advance |

What is a Market Order

A market order is executed at the current market price as quickly as possible when you place the order. You can use it to place both buy and sell orders.

You can select [Buying price/Selling price] and [Trading Volume/ Selling amount] to place a buy or sell market order. For example, if you want to buy a certain quantity of BTC, you can enter the trading volume directly. But if you want to buy BTC with a certain volume of funds, you can use the scrolling bar below.

How to View My Spot Trading Activity

You can view your spot trading activities from the Orders and Positions panel at the bottom of the trading interface. Simply switch between the tabs to check your open order status and previously executed orders.

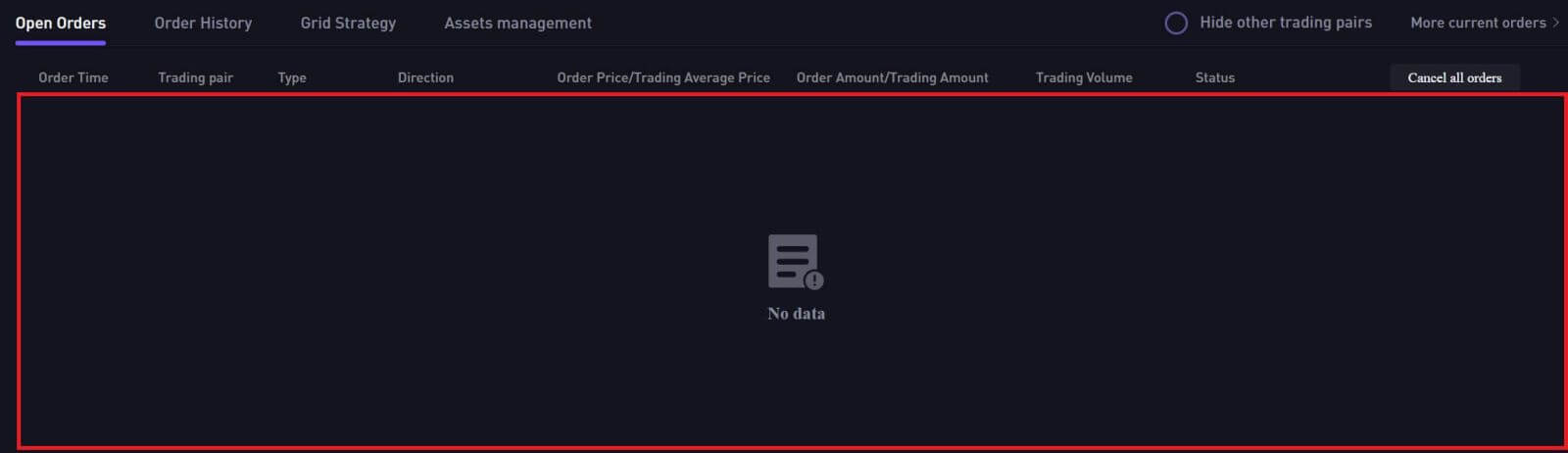

1. Open orders

Under the [Open Orders] tab, you can view details of your open orders, including:- Order Time

- Trading pair

- Order type

- Order Direction

- Order price

- Order Amount

- Filled %/ Trading volume

- Total amount

- Status

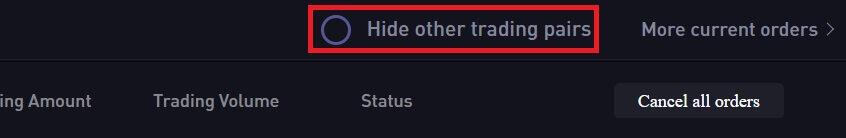

To display current open orders only, check the [Hide other trading Pairs] box.

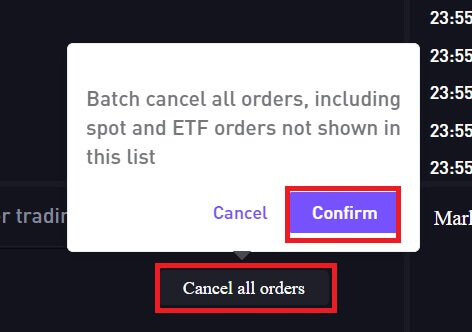

To cancel all open orders on the current tab, click [Cancel all orders] and select [Confirm] to cancel.

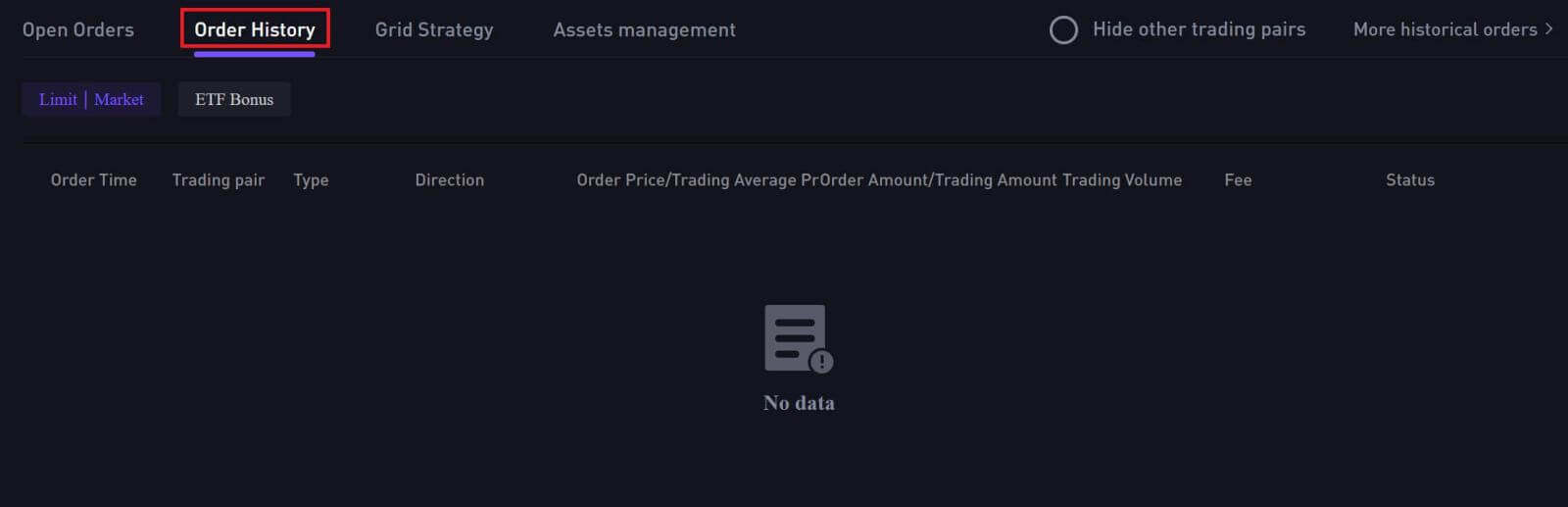

2. Order history

Order history displays a record of your filled and unfilled orders over a certain period. You can view order details, including:- Order date

- Trading pair

- Order type

- Order price

- Order Direction

- Filled order amount

- Filled %

- Fee

- Total amount

- Status

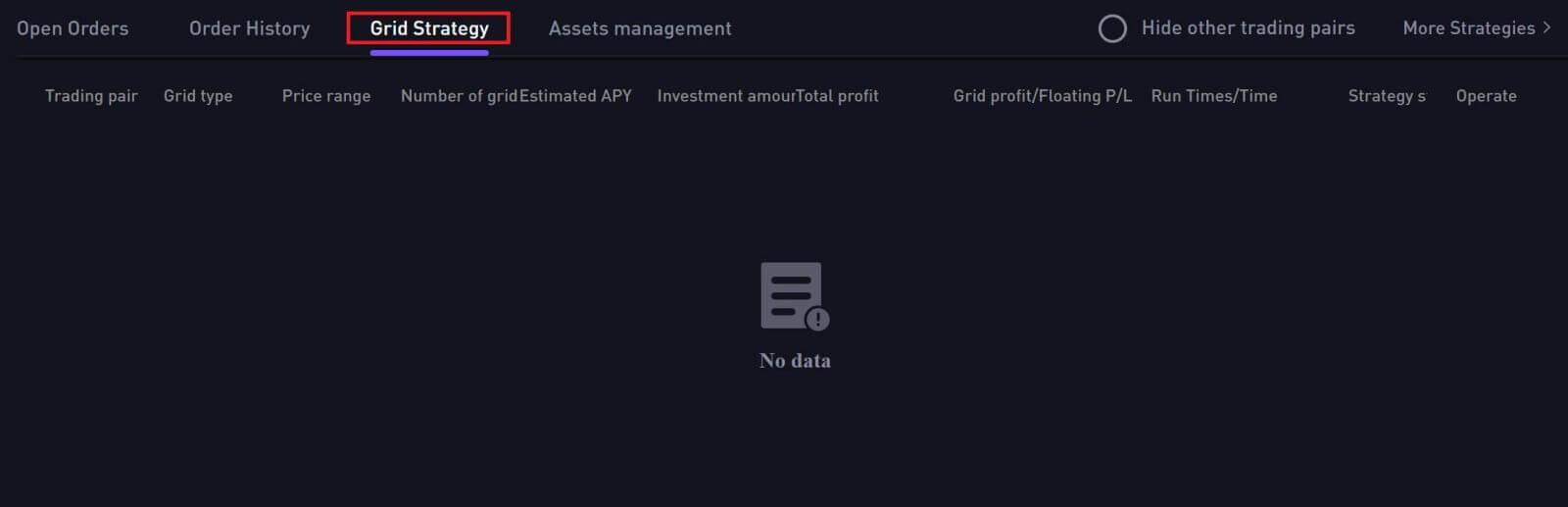

3. Grid Strategy

Grid Strategy displays a record of your filled and unfilled Strategies over a certain period. You can view Strategy details, including:

- Trading pair

- Grid type

- Price range

- Number of gridEstimated APY

- Investment amount total profit

- Grid profit

- Run Times/Time

- Strategy

- Operate

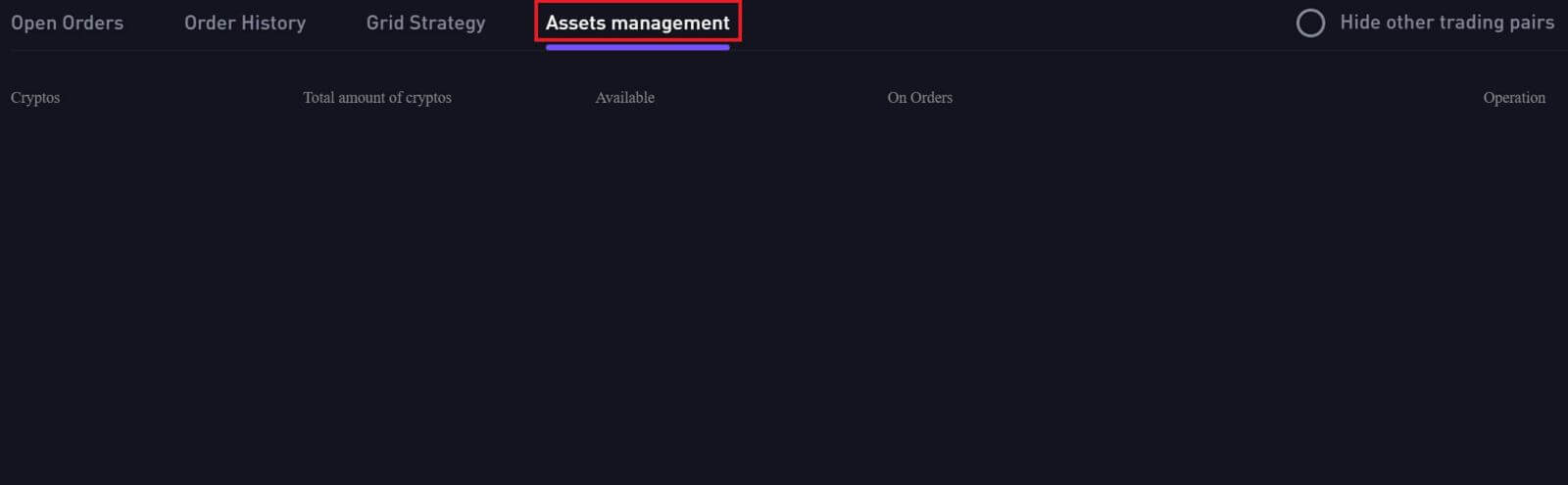

4. Assets management

Assets management displays a record of your filled and unfilled Assets over a certain period. You can view Assets details, including:

- Cryptos

- The total amount of cryptos

- Available

- On Orders

- Operation